There is still much uncertainty about what will change, when it will change, and how it will change, but it seems pretty clear that some fundamental modifications are going to be made to the Tax Code as part of the new administration. The following is my attempt to summarize the relevant proposed changes along with my educated guess on what is really likely to get done. Some of the modifications to the Tax Code, if they were 100% certain, would lead to tax-saving recommendations for many of you. Unfortunately, virtually nothing is certain. For example, if marginal tax rates fall in 2017 from 2016, then it would make sense to accelerate deductions into 2016 that could otherwise be taken in 2017. But, if those rates don’t change until 2018, and there are offsetting factors that impact 2017 (Alternative Minimum Tax or “AMT”, for example), taking those deductions in 2016 instead of 2017 could actually raise the overall 2016 + 2017 tax bill. Still, for most of you, I think there are some takeaways that are likely to help in the best case scenario, and unlikely to hurt in the worst case scenario. I conclude this post with my advice on those items.

Before jumping into the likely/proposed changes, there’s an important point that I want to make. Yes, Republicans have control of the House, the Senate, and the Presidency, so you might think that they will have their way without debate. However, they don’t have a filibuster-proof, sixty members of the Senate which may force some negotiation. Yes, there are some things that can be changed through the Budget Reconciliation process, which requires a simple majority of Congress, and yes, they have the “nuclear option” available, which Harry Reid famously used as Senate Majority Leader in 2013 to eliminate the filibuster in particular cases. But, the current Senate Majority Leader, Mitch McConnell, is on record as a proponent of the filibuster and as saying after the election that “I don’t think we should act as if we going to be in the majority forever… We’ve been given a temporary lease on power if you will, and I think we need to use it responsibly.” There’s also the matter of the national debt (approaching $20 Trillion) and an annual deficit at over $500 Billion and projected to increase dramatically over the next few years, without even considering the tax changes discussed here and the potentially $1 Trillion in infrastructure spending that is proposed. We simply can’t just cut taxes, increase spending, and assume all will be ok. So, it’s in everyone’s best interest to pass a bipartisan set of changes to the tax code with reasonable tax relief that will stimulate economic growth (some of which will lead to additional tax revenue), and keep spending in line. Whether or not that gets done remains to be seen. I suspect Republicans will mostly get their way, but will stop short of steamrolling the entire Trump/House plan through with no Democratic participation and without any concern for the deficit. If they do, it seems very likely that all of these changes will be temporary and reversed as soon as the power pendulum swings back toward the Democrats or the country’s ability to borrow cheaply is taken away. Said another way, the more moderate the changes, the more likely they are to persist for the long-term. The more extreme the changes, the shorter the likely duration before those changes are repealed.

So what changes are we talking about?

· A reduction in corporate tax rates – Current rates range from 15% for the first $50k of corporate income to 35% for income over $18.33M. Trump and the House plan want to cut the top rate to 15%, while eliminating many deductions and credits (“tax expenditures”), including the ability to defer tax on foreign earned income until it is repatriated. Included in the proposal is a one-time tax on previously deferred foreign income that is repatriated to the US (a “repatriation holiday” of sorts). It’s very likely that a reduction in the top rate will take place as will some sort of repatriation holiday. If I had to bet, I’d guess the top corporate marginal tax bracket will wind up somewhere between 20-25% and a one-time 10% tax on repatriated income will apply. The likelihood of this occurring, is in my opinion, the biggest factor in the gains in the US stock market since the election (notably non-US stocks have been excluded from the rally). The repatriation tax will be used to fund a portion of the infrastructure program, which may be a public-private partnership to keep the Federal cost down. Also unclear is whether the new corporate tax rate will apply to small business pass through income (LLCs, partnerships, and S-Corps). Trump’s original plan was for that to happen. That then morphed to only include the lower corporate tax on profits that were reinvested in the business. Now it seems more like that the current method of simply passing through income to be taxed at individual rates will be maintained. Due to the small chance that pass-through income will be taxed at a lower rate under the new plan, deferring income and accelerating expenses makes the most sense on the margin.

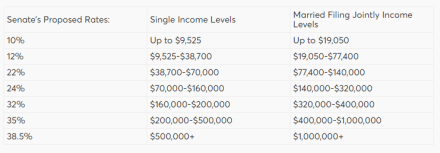

· A reduction in individual tax rates – Current rates are graduated at 10%, 15%, 25%, 28%, 33%, 35%, and 39.6% each applying to an increasing income level (see https://blog.perpetualwealthadvisors.com/wp-content/uploads/2016/10/taxprojectionspptforblog2017.pdf for more detail on each bracket). The Trump plan and the House plan call for compressing the tax brackets to 12%, 25% and 33%, while eliminating various deductions (see below). The House plan would compress the 10% and 15% bracket to 12%, the 25% and 28% bracket to 25% and the 33%, 35%, and 39.6% brackets to 33%. Trump’s plan used 12% on income up to $75k, 25% up to $225k, and 33% above that (all for married filing jointly). The Trump and House plans align pretty closely. I suspect the bottom two brackets will compress close to the proposed 12% and 25%, but that the top rate could only drop to 33% if there was a substantial decrease in deductions for taxpayers in those brackets and/or the addition of something like the “Buffet Tax”, which was proposed by Warren Buffet as a new Alternative Minimum Tax for those earning over $1M per year. We’ll need to watch and see what legislation looks like when drafted and what kind of support it gets through Congress before taking action on this. I think it’s safe to say that rates will at worst be the same, and likely will be lower in the future than they are now (whether that’s 2017 or 2018 remains to be seen). All else being equal, this means that deferring income, where possible, to a future year will likely not hurt, and likely will help most taxpayers.

· An Increase in the standard deduction and elimination of a number of itemized deductions – Trump’s plan would increase the standard deduction to $15k single / $30k married vs. today’s $6350 single / $12,700 married while eliminating the personal exemption ($4050 per family member including children, but eliminated at high income levels and in AMT). He would cap itemized deductions at $100k single / $200k married regardless of the type of the deduction. The House plan calls for the elimination of virtually all deductions with the exception of the mortgage interest deduction and charitable contributions. If the House gets their way, the deductions for medical expenses (not a huge deal since they have to exceed 10% of AGI to be deductible anyway), state and local income or sales taxes (a pretty big deal, esp. in high tax states), property taxes (somewhat of a big deal for homeowners), and misc. itemized deductions (only a big deal for those who have misc deductions that exceed 2% of their income), would be eliminated. There have also been proposals in the past to limit the mortgage interest deduction to $500k, and/or to limit the impact of a deduction to 25% or 28%, effectively reducing their value to high-income individuals so that the value of the deductions is in-line with middle-incomers. An overall limit to deductions is thought to be a problem for charitable giving, since it takes away the financial reward for giving more than $200k per couple per year for upper incomers. The selective elimination of certain deductions instead creates winners and losers somewhat haphazardly and changes the rules on taxpayers in the middle of the game (if you bought a house figuring you’d be able to write off the property taxes, what happens if you can’t and that makes the house less affordable?). I’m not sure where this will fall out. What is clear is that there is a strong possibility of deduction limits in the future. In many cases, this means accelerating deductions into 2016 where possible, is probably the best tactic (though AMT makes this hard to generalize).

· An expansion of the Child Tax Credit and the Dependent Care Credit (and/or Dependent Care Flexible Spending Accounts) – Trump has proposed changes that would allow individuals to deduct childcare and elder care from their income, incent employers to provide on-site childcare, and create tax-free savings accounts for children and elderly dependents. No details have emerged. I suspect an expansion of the Child Tax Credit ($1k per child, phased out by income) and a higher Dependent Care Credit and/or higher dependent care FSA limits (currently $5k per family). There is no way to take advantage of these changes in advance, even if we knew they would occur for certain.

· An elimination of the Alternative Minimum Tax (AMT) – AMT is a parallel income tax calculation that has a bigger personal exemption, fewer allowed deductions, and only two tax rates (26% and 28%). You pay either the standard income tax or the alternative minimum tax, whichever is higher. AMT is typically paid by middle-high income taxpayers with a lot of deductions that are allowed for regular tax purposes, but not allowed for AMT purposes. Those include state & local income & sales taxes paid, property taxes paid, miscellaneous itemized deductions (like unreimbursed employee expenses). AMT also hits those who receive Incentive Stock Options (ISOs) from their employer and exercise those but hold the stock. So if you live in CA, work in Silicon Valley, have a bunch of ISOs, an expensive house with high property taxes, and pay CA’s very high state income taxes, you’re likely facing AMT. Eliminating AMT will be a huge win from a complexity standpoint. I’d give it about a 50% chance of happening, though there’s also the chance for something like the AMT to be added under a different name (like the “Buffet Tax” mentioned above).

· A repeal / replacement of some of the various tax provisions associated with the Affordable Care Act (“ACA” or “Obamacare”) – these include the penalty for not having insurance, the subsidies for insurance purchased through the exchange for those with low income, and the surtax of 3.8% on investment income if you earn over $200k single / $250k married in income per year. Notably, the 0.9% Medicare surtax on earned income over $200k / 250k looks like it would remain. It’s likely that other credits / penalties would need to be created / imposed in whatever ultimately replaces the ACA. The elimination of the NIIT seems pretty likely and would mean that investment income (interest, dividends, gains, rents, etc.) will be taxed 3.8% less in the future than it is today for those with incomes of at least $200k (single) / $250k married. It’s not a huge amount, but it could be worth trying to defer investment income into that future year if possible (i.e. if you’re selling something with a big gain in Dec 2016, you might be better off waiting until Jan 2017 instead, all else being equal).

· A repeal of the Federal Estate Tax along with an elimination of “stepped-up” basis and elimination of the tax deduction for giving appreciated assets to a private foundation / charity – Some Republicans have an issue with eliminating stepped-up basis (heirs receiving property get a cost basis equal to the fair market value of the property as of the date of death of the decedent). Many Democrats have an issue with eliminating the Estate and Gift tax completely. This one seems unlikely to me. At present, couples are exempt from Estate Tax if their estate’s (plus lifetime gifts) are less than ~$11M. So while the concept of taxing wealth at death after already having taxed the income that created that wealth multiple times doesn’t seem completely right, eliminating the tax would clearly only benefit the uber-wealthy and that’s a tough sell given the other tax cuts and the current debt.

Note that no changes are expected in dividends / long-term capital gains rates, other than the elimination of the 3.8% NIIT described above.

To summarize, here are the actions you should take in order to most likely benefit if the changes above go into effect in 2017. Keep in mind that nothing is certain and it is possible that taking any of these actions could lead to the exact opposite of the intended tax savings. This is a probabilities game at best.

1) Defer income from work to 2017 from 2016 where possible. You obviously can’t change your salary, but perhaps year-end bonuses or severances are negotiable. More importantly, any self-employment income may be able to be shifted by a month or two as necessary.

2) Consider putting off the exercise of employer stock options, or accepting any deferred compensation payouts until 2017.

3) If you’re not maxing out pre-tax savings vehicles like 401ks, consider increasing your contribution for the last pay period of 2016. You have until 4/15/2017 to fund 2016 Traditional IRAs / HSAs, which means you can hold off on those and see if we have more information by then.

4) If your total income is greater than $200k (single) or $250k (married), and you can defer taking investment income in 2016 to 2017 (e.g. put off a large capital gain until January), do it.

5) Accelerate deductions that aren’t impacted by AMT from 2017 to 2016. For example, consider making future years’ charitable contributions in 2016 if possible. Pay your January mortgage payment in December to get the extra month’s mortgage interest into 2016. Pay any medical expenses that you can if your total for the year exceeds 10% of your income.

6) If you’re not impacted by AMT, accelerate other deductions from 2017 to 2016. For example, if you control the timing of the payment of your property taxes and you have the choice between a payment in calendar year 2016 or 2017, make the payment in 2016. If you make estimated tax payments, consider paying your Q4 2016 estimated taxes in December 2016 rather than January 2017.

7) If you are impacted by AMT, and a particular deduction like payment of property taxes is unlikely to help you because it will be offset by AMT, then continue to make that payment on the schedule that you usually use (i.e. pay one year’s worth of property tax each year unless your income or other deductions are going to change substantially from year to year).

8) Don’t die with an estate valued at over $11M in 2016. Hold off until 2017 if possible just in case the estate tax is repealed. 😉

As with most financial planning, these are just generalizations. And, in this case, they’re generalizations grounded in the uncertainty of future tax policy. If you have questions about your specific situation, contact your financial advisor.