The House and Senate have now passed the tax bill (though the House needs to vote again after some minor amendments in the Senate) and then it will be on its way to the President for signature. While anything is possible, and the odds of the President signing in January rather than December have increased dramatically, it seems safe to assume that the bill will eventually become law. There’s not a ton of time left to take action and there aren’t a lot of people who can take any action to take advantage of / avoid the disadvantages of the new tax law. In this post, I’ll outline what you might be able to do, why you might be able to do it, and (maybe most importantly) why it may not work in certain situations. These are general rules. Proceed with caution. Things can get very complicated and unintended consequences are possible. The bill has not yet become law and there is some small risk that something prevents it from becoming law which means that actions you take under the assumption that it will become law may backfire. I tried to keep this list simple, but unfortunately, there’s just no way to do that while providing enough actionable information. Taxes simply aren’t simple. Thanks Congress!

Consideration #1

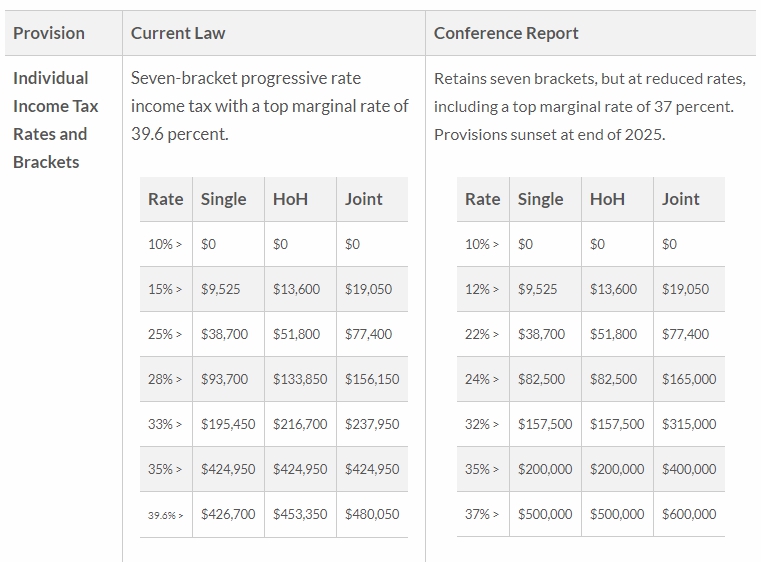

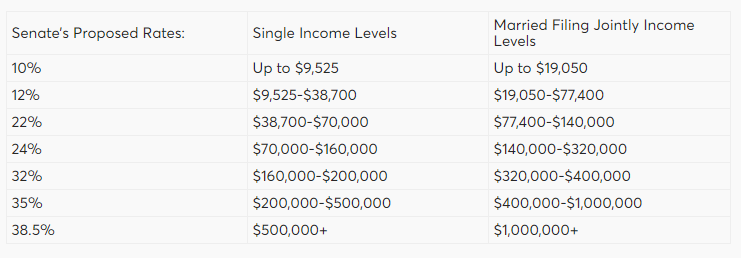

Because: Federal tax rates are falling for every tax bracket in 2018,

Consider: Deferring income to 2018 from 2017 when you have the ability to do so,

Unless: You’re going to have substantially more income in 2018 than 2017 that could push you up to the next tax bracket OR you’re able to deduct state income taxes this year that you won’t be able to deduct next year (see below) and those state income taxes cause more tax savings than deferring the income to a lower federal rate year.

Examples:

- avoid exercising non-qualified employee stock options in December that could be exercised in January 2018 (all else being equal)

- contribute more to your 401k in the final payroll of 2017 and less in 2018 (but not less than the match amount),

- defer some end of year revenue if possible if you’re self-employed or have a side job, or accelerate some expenses that you can take in 2017 instead of 2018 (including equipment purchases that would qualify for Sec 179 immediate expensing). This is especially important if your business would qualify for the 20% deduction on pass-thru income in future years.

- perform deductible repairs / maintenance on rental properties in 2017 that you were considering doing in 2018.

Consideration #2

Because: Federal tax rates are falling for every tax bracket in 2018,

Consider: Accelerating deductions to 2017 from 2018 when you have the ability to do so since they will have a larger impact in reducing your taxes in 2017,

Unless: You’re going to have substantially more income in 2018 than 2017 that could push you up to the next tax bracket OR those deductions wouldn’t provide as much (or any) benefit in 2017 as they would in a future year due to the Alternative Minimum Tax (AMT) in 2017, or because you can’t itemize in 2017.

Examples (but see below for limitations):

- Pay any state income tax that you might owe for 2017 via an estimated tax payment before the end of 2017. Note: this won’t work if you’re already “in AMT” for 2017 and you have to reasonably believe that you owe what you pay (can’t just pay an extra amount in 2017 to deduct it Federally and then receive a big state refund in 2018 and take it as income Federally at a lower tax rate).

- Pay your Jan 1st mortgage payment prior to the end of December 2017 (your mortgage lender should report the interest for that payment on your 2017 1098), though most people do this already.

- Pay outstanding property tax bills that aren’t due until some time in 2018 before the end of 2017 (this is only relevant in certain jurisdictions that bill in one year but set the bill’s due date in the following year). Note: this won’t work if you’re already “in AMT” for 2017 and you generally can’t prepay future year property tax bills that haven’t been generated yet.

- Make additional charitable contributions in 2017 that you would have otherwise made in a future year or consider starting a Donor Advised Fund which allows you to make a lump charitable contribution into a fund, take the full deduction this year, and then distribute to charity in future years as you see fit.

- Take any Miscellaneous Itemized Deductions in 2017 that you would have otherwise taken in a future year (see link for list). Note: this won’t work if you’re already “in AMT” for 2017.

Comment: How do you know that you’re “in AMT” for 2017? If your income and deductions are similar in 2017 than they were in 2016, you can use your 2016 taxes as a guide. Check line 45 of your 2016 Form 1040. If there is a number on it, you’re “in AMT” and assuming the same situation in 2017, you will not benefit from those items above marked as not working if you’re in AMT. If there’s no number on line 45 it means you likely wouldn’t be in AMT if you didn’t pay additional state income / property taxes or those items that would be considered Misc. Itemized Deductions. But, if you do make those extra payments, it could push you into AMT. To determine how much room you have until you hit AMT, check with your tax preparer who should be able to go back to your 2016 return and slowly increase your deductions that aren’t deductible for AMT until you hit AMT. That will give you an approximate limit to the extra payments you can make in 2017 before hitting AMT. If your 2017 situation is different from 2016, then the only way to know how much room you have for additional payments in 2017 is to prepare a mock tax return for 2017 which is not an easy task as it means gathering all the information that would be on your tax documents (W-2, 1099s, 1098s, etc.) without actually getting your tax documents in the mail.

Consideration #3

Because: The standard deduction is increasing substantially starting in 2018, fewer and fewer people will be able to itemize, meaning that their deductions won’t provide any benefit above the standard deduction. To estimate whether you’ll be able to itemize or not in 2018, add up the following for 2018 (use your 2016 Schedule A as a guide if your situation is going to be the same: 1) state/local taxes = the sum of Line 5 + Line 6 of your Schedule A, but only $10k as a max, 2) mortgage interest = Line 15 of your Schedule A (but back out any mortgage interest that’s associated with a HELOC, 3) charitable contributions = Line 19 of your Schedule A. If you are single and the above adds up to less than $12k or if you’re married filing jointly and it adds up to less than $24k,

Consider: Accelerating deductions to 2017 from any future year.

Unless: those deductions wouldn’t provide any benefit in 2017 due to the Alternative Minimum Tax (AMT) in 2017, or because you can’t itemize in 2017.

Examples: Same as Consideration #2

Comment: Same as Consideration #2.

Consideration #4

Because: The deduction for state/local taxes paid is going to be limited to $10k per year (both Single and Married Filing Jointly!), which includes state/local income taxes, sales taxes, and property taxes,

Consider: Accelerating deductions to 2017 from 2018 for state/local income/sales taxes or property taxes,

Unless: those deductions wouldn’t provide any benefit in 2017 due to the Alternative Minimum Tax (AMT) in 2017, or because you can’t itemize in 2017. Note that if the total of your state/local tax deductions in future years will be less than $10k, the only benefit here is that which is described by #2 above.

Examples (note that none of these work in AMT):

- Pay any state income tax that you might owe for 2017 via an estimated tax payment before the end of 2017. Note that the tax bill specifically outlaws pre-paying 2018 state income taxes. They would not be deductible in 2017 and would instead be treated as paid in calendar 2018 so that the system can’t be gamed.

- Pay outstanding property tax bills that aren’t due until some time in 2018 before the end of 2017 (this is only relevant in certain jurisdictions that bill in one year but set the bill’s due date in the following year). You can only do this if the bill has already been generated. Also, for those who pay their property taxes through an escrow account, you can still make a payment out-of-pocket. Your escrow company will eventually make the same payment and it should be refunded back to the escrow account or back to you at that time. If it goes back to the escrow account, your next escrow reconciliation will pick up the overpayment and refund it back to you.

- If you live in a state with no income tax and you instead deduct sales taxes, and you’re planning to buy a big ticket item (car, truck, boat) soon, do it before the end of 2017 so you get the additional sales tax deduction in 2017.