The Senate has now released its version of the Tax Cuts & Jobs Act. I thought it would be helpful to re-post the House plan points from my last blog post and update with how the Senate plan would treat each item. Again, all of this is subject to change before a final bill is put together and voted upon. Each chamber needs to pass its version of the bill (after votes on various amendments). Then the two bills will be reconciled in Committee to produce a final bill. Then both chambers need to pass that bill. Then the President needs to sign it. Long path ahead with many changes likely.

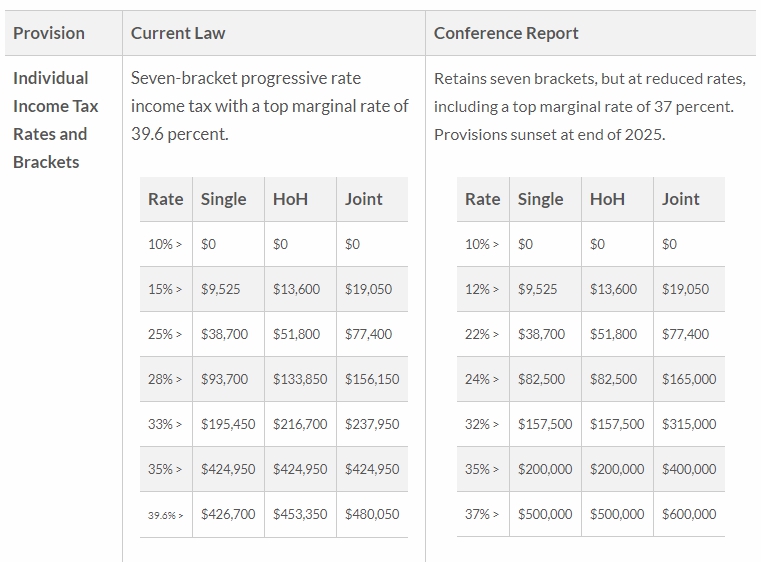

- Income tax rates fall for everyone. The current 7 tax brackets would be compressed into 5: 0%, 12%, 25%, 35% and 39.6% (the 0% rate applies due to deductions and exemptions which subtract from income causing the first $x of income to be subject to no tax).. For singles, the 12% rate would run to $45,000, the 25% rate would top out at $200,000, the 35% one would end at $500,000, and the 39.6% rate would kick in for taxable incomes that exceed $500,000. For marrieds, 12% rate up to $90,000, 25% would max out at $260,000, 35% would end at $1 million, and the 39.6% rate would apply above $1 million. The 12% on the first $45k or 90k of income wouldn’t apply for those in the top tax bracket. Note that this schema reduces the marriage penalty that exists in the current tax brackets since the married brackets (with the exception of the 25% bracket) are double the single brackets.

Senate Plan: 8 brackets, like today, but with different rates and caps. Those rates are 0%, 10%, 12%, 22.5%, 25%, 32.5%, 35%, and 38.6%, with the top bracket at $500k single, $1M married, like the House plan. Would also change the “kiddie tax” such that a child’s investment income is taxed with trust and estates rates (higher), vs. being taxed at the parent rate after a threshold.

- No change in tax rates for dividends and long-term capital gains. 0% applies if income puts you in the old 0%, 10%, or 15% tax bracket, 15% applies if in the prior 25%, 33%, or 35% bracket, and 20% applies if in the old 39.6% bracket.

Senate Plan is the same and specifically calls out that only the FIFO (first in first out) method of tax lot reporting will be allowed for the determination of gain (or average cost in the case of funds).

- AMT is completely repealed.

Senate Plan is the same.

- The standard deduction is increased for everyone, but the personal exemption no longer applies. The standard deduction would be $24k for married filers (vs $13k now) and $12k for singles (vs. $6500 now). The $4150 per person personal exemption (which was phased out for upper incomers and treated differently for those in AMT) is eliminated.

Senate Plan is the same, thought the house plan eliminated the extra standard deduction for those age 65 and over and those who are blind while the Senate retains those additional standard deduction amounts.

- The child tax credit is increased. It would be $1600 per dependent age 16 and under (vs $1000 today). The income phaseouts are increased as well ($75k single / $115k married now to $115k single / $230k married).

Senate Plan would increase the credit to $1650 per dependent, raise the age to age 17 and under, and raise the income phaseouts to $500k single, $1M married.

- A new, temporary $300 tax credit for each adult taxpayer and each dependent over age 16. This applies for 5 years only and essentially offsets part of the loss of the personal exemption. It also phases out at higher incomes.

Senate Plan does not include this new temporary credit.

- Several credits go away. These include:

- Adoption Credit

- Credit for purchase of Plug-In Vehicles

- Hope Scholarship Credit & Lifetime Learning Credit, though the larger American Opportunity Credit remains.

Senate Plan retains these credits

- Several itemized deductions go away or are reduced. Keep in mind though that with the higher standard deductions, fewer people will need to itemize so loss of some of the below isn’t as bad as it seems. These include:

- State and local tax deduction eliminated. Senate Plan is the same.

- Property tax deduction limited to $10k per year and only applies to real estate (no more auto registration deduction). Senate Plan completely eliminates the property tax deduction.

- Mortgage interest deduction would only be allowed on up to $500k of new mortgage debt (vs. $1M today), only for primary residences (vs. first and second homes today), and there would be no more $100k of HELOC debt interest deduction allowed. Existing mortgages (closing prior to 11/2/2017 or with a binding contract prior to that date) would be grandfathered in the old rules. Senate Plan retains the $1M cap, but still eliminates the $100k of HELOC debt interest deduction.

- Casualty loss deduction eliminated (unless specifically authorized by special disaster relief). Senate Plan is the same.

- Medical expenses > 10% of AGI deduction eliminated. Senate plan retains this deduction.

- Tax prep fees, and unreimbursed employee expenses (including mileage) would be eliminated. Senate plan also eliminates these deductions, but goes a step further by eliminating all Misc. Itemized Deductions that are subject to the 2% of AGI floor (see IRS Publication 529 for a list of these deductions)

- Other deductions / exclusions go away or are reduced. These include:

- Moving expenses deduction eliminated. Senate Plan is the same.

- Alimony deduction eliminated and alimony would no longer be taxable to the receiver. Senate plan does not modify alimony rules.

- The student loan interest deduction is eliminated. Senate plan retains this deduction.

- The tuition and fees deduction is eliminated. Senate plan retains this deduction.

- Sec 121 exclusion of gain on the sale of a principal residence is significantly changed. Instead of the exclusion applying regardless of income as long as the seller owned and lived in the residence for 2 of the last 5 years, the exemption would now be phased out for upper incomers (starts at $250k individual and $500k married) and the own/live requirement would be 5 of the last 8 years. Senate Plan also includes the 5 of the last 8 condition, but excludes the income caps.

- Retirement accounts are unchanged (401ks, Traditional IRAs, Roth IRAs, SEPS, SIMPLES, etc. Note that there are strong rumors that the Senate plan will change this, removing or reducing the ability to save pre-tax for retirement.

Senate Plan makes some changes to 457, 403b, and 401k plans so that they all use the limits of today’s 401k plans (no additional catch-up for 403b and governmental 457 plans going forward). It also clarifies that the aggregate contribution rules apply across all retirement plans, not just retirement plans of the same type. Finally, it eliminates “catch-up” contributions for individuals whose wages exceeded $500k in the prior year.

- 529 College Savings Plans would be enhanced. Specifically:

- $10,000/year of tax-free distributions would be allowed from 529 college savings plans for (private) elementary and high school expenses

- 529s could be created for unborn children

Senate Plan does not include these changes.

- The estate tax would be reduced and then eliminated. The exemption would be doubled for 2018 and eliminated completely in 2024. The gift tax system would be kept in place to prevent gaming the income tax system by shifting assets to those in lower tax brackets.

Senate Plan doubles current exemptions, but keeps the estate tax in place.

- ACA (“Obamacare”) provisions remain unchanged. The Individual Mandate (requiring health insurance or paying a penalty) remains, as do the other ACA-imposed Medicare surtaxes on wages and investment income.

Senate Plan also leaves the ACA unchanged.

- Some employee benefits changes. These include:

- No more dependent care FSAs

- No more adoption benefits

- No more tuition reimbursement plans and no more reduced / free tuition for employees of educational institutions.

- No more moving expense reimbursements.

- No more pre-tax transportation plans (parking / commuting).

- No more free gym memberships or similar amenities without including their value in taxable income.

- 401k hardship withdrawals would still be subject to tax and penalties, but could now include employer contributions and employees would no longer be prevented from making new contributions to the plan for 6 months.

- 401k plan loan repayments get a little easier in the case of a termination. Rather than needing to repay the loan within 90 days of termination or treating the loan as a distribution, borrowers would have the ability to repay the loan to a new retirement plan or IRA by the due date of that year’s tax return (including extensions).

Senate Plan does not contain this language except for the moving expense reimbursements. Those would not be allowed in the Senate plan either. There would also no longer be deductions to the employer for (1) an activity generally considered to be entertainment, amusement or recreation, (2) membership dues with respect to any club organized for business, pleasure, recreation or other social purposes, or (3) a facility or portion thereof used in connection with any of the above items.