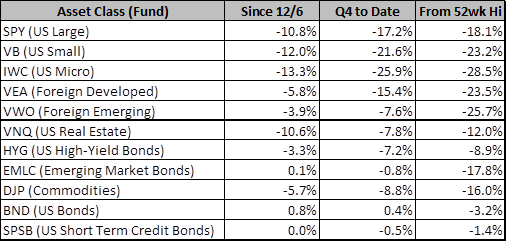

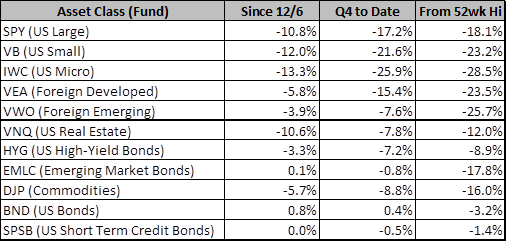

This was a rough week for the stock market, coming after an already ugly start to the quarter. Since my last update on 12/6, global stock markets have continued to decline, with the US finally starting to catch down to the malaise that the rest of the world has been experiencing for most of 2018. Surveying the damage, here are the % changes since 12/6, since start of Q4, and since the 52-week high for various ETFs (ignoring dividends):

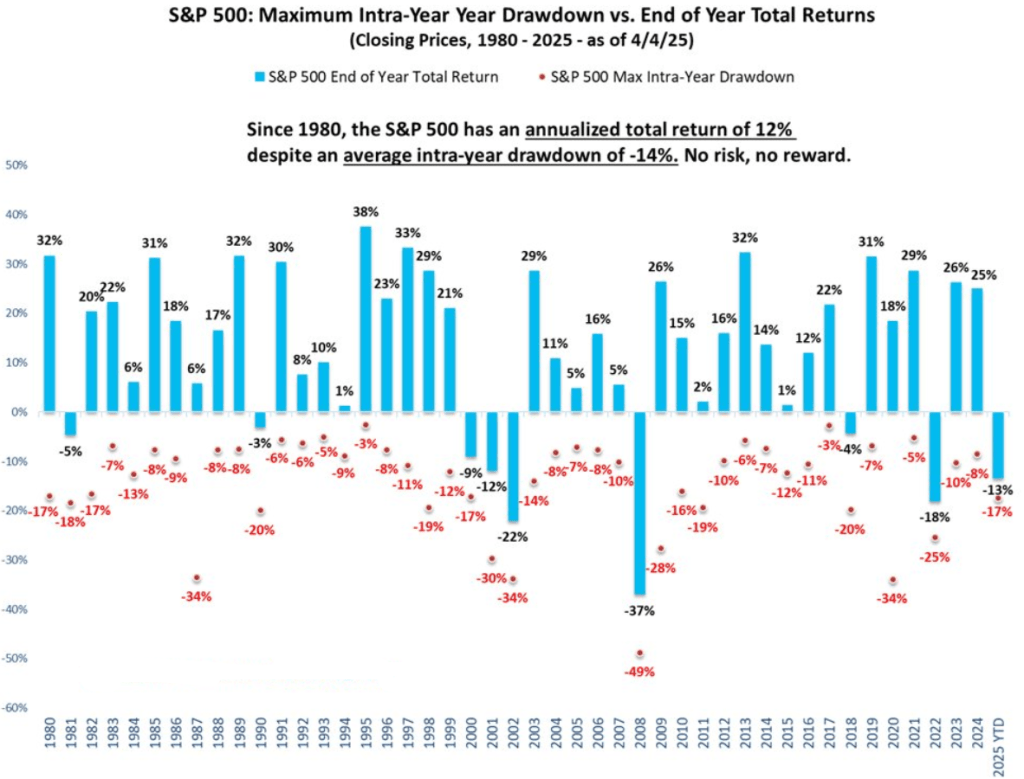

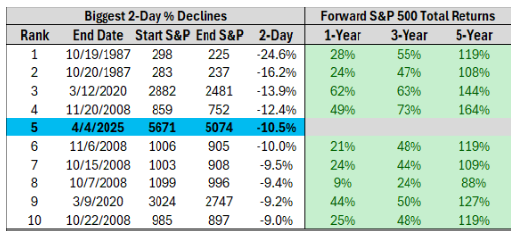

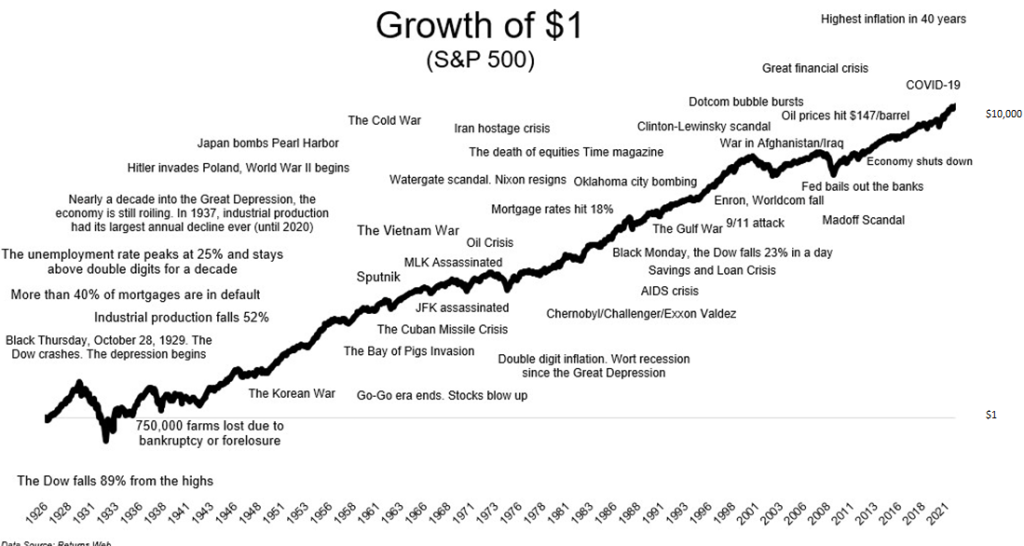

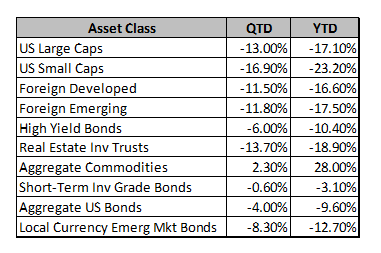

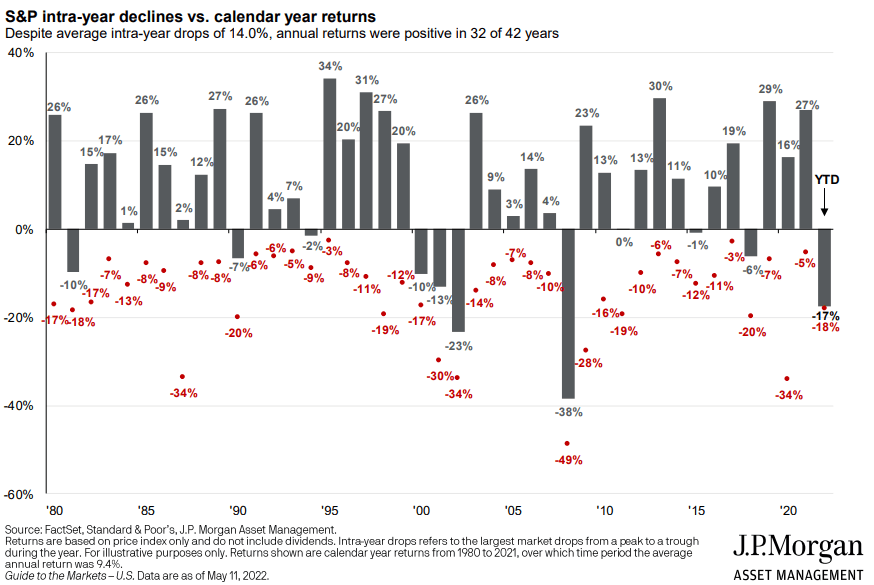

The most aggressive portfolios are down 15-20% for the quarter. The most conservative are approximately flat. Most of your portfolios lie in between with retirement portfolios for those of you with a long way till retirement being quite aggressive, but likely still down 10-18%, balanced portfolios down 7-14%, and more conservative portfolios down a few percentage points. Almost all portfolios are now down from where they were a year ago. As I said in the 12/6 update, this may seem like an extreme drawdown after years of low volatility, but from a historical context it’s not. It has happened faster than most declines in the recent past, but that could very well be a good thing if it means a shorter interval of declines. I don’t really worry about the short-term movements of stocks, but I do worry about the damage to consumer and business confidence that deep, drawn out declines can cause. Losses never feel good, but as long as we can stand the loss without needing to liquidate or liquidating in panic, they actually are good in two ways. They reset stocks and asset classes to lower valuations while shaking out the weak-handed or leveraged market participants, providing a future opportunity to grow. They also provide an opportunity to invest more money at lower prices. If you invest $1,000 per month for 20 years in a market that gains 8% per year every year vs. a market that ends in the same place but experiences 20% losses every 5 years along the way, you wind up with almost $45,000 more in the latter case. This is what we experienced from the 2007 top to the recent 2018 top. Without the financial crisis and its opportunity to invest at MUCH lower prices, portfolios wouldn’t be nearly as big as they are today. Try to keep this in mind when dealing with the pain of quarters like this one.

As far as why this is happening, I outlined the major market concerns in Part 2 of my last post. I won’t rehash those. But in the last couple of weeks, the following distinct events occurred that added to market uneasiness around those points:

· Trade talks resumed with China, but the administration said (after many mixed messages) there is no flexibility on the 3/1/19 deadline for a deal. They also are on record saying a deal would be difficult in such a short period, and the president is on record saying that if it doesn’t happen, he’s ok proceeding with increased tariffs, “I’m a tariff man”. Without getting political, this does not inspire confidence in a resolution to the trade war. In fact, it tells international markets to prepare for intensification.

· Oil continued to plunge, down 12% from 12/6 and a whopping 38% just in Q4 2018. While this is good for the average consumer (gas prices, heating oil, airline tickets, shipping costs), it is not good for that portion of the US economy, which has had massive growth and has taken on a lot of debt over the past 10 years. High debt and low oil prices will pressure the balance sheets of oil companies and ultimately lead to defaults, bankruptcies, and business closings. None of those are good for markets and the weakness in the energy sector is causing tightening in credit markets with potential for spillover outside of energy.

· Federal Express released earnings that were mostly in-line with estimates, but substantially decreased guidance for the remainder of their fiscal year (two more quarters) on a slowdown in global shipments. One might think this is the classic attempt at UPOD (under promise over deliver) and that FedEx was using recent market weakness as an opportunity to set expectations low for the next few quarters. However, they’re actually acting on their reduced forecasts by reducing their global shipment processing capacity. You don’t do that unless you know the economy is slowing, at least internationally. They’re just one company, but as a global shipping juggernaut, their actions are concerning.

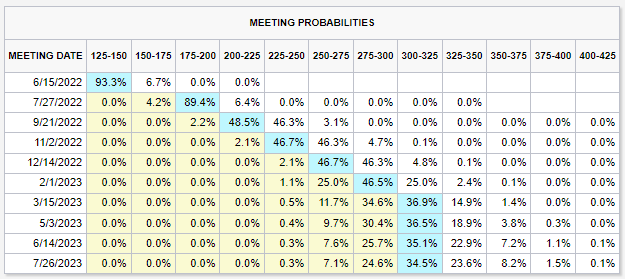

· The Federal Reserve held its last meeting of 2018 and raised interest rates by another 25 basis points. The move was widely expected, though there was hope that they would instead pause given recent market performance. They did not pause and while they walked back their estimates for the neutral interest rate as well as expectations of 2019 hikes (from 3 to 2), that was not enough for markets. Fed Chairman Jay Powell tried to ease markets during his press conference by repeatedly stating that there was no pre-determined course for interest rates and that the Fed would adjust their policy and their forecasts as economic data came in. Then he made a huge (in my opinion) communication error by stating that the Fed would not alter their plan to reduce their balance sheet (reverse the Quantitative Easing purchases of treasuries using printed money), commonly known as Quantitative Tightening. While I’m sure he meant that it wouldn’t be altered except in extreme conditions, he said flat out, that it wouldn’t be altered. Stocks tanked as a result. There have since been attempts to walk those comments back by the other Fed governors, but the damage to confidence has already been done. This is not as bad as an actual Fed policy mistake, but a communication mistake that causes volatility and a loss of confidence in the Fed as a backstop when the proverbial “stuff” hits the fan, really shakes the markets.

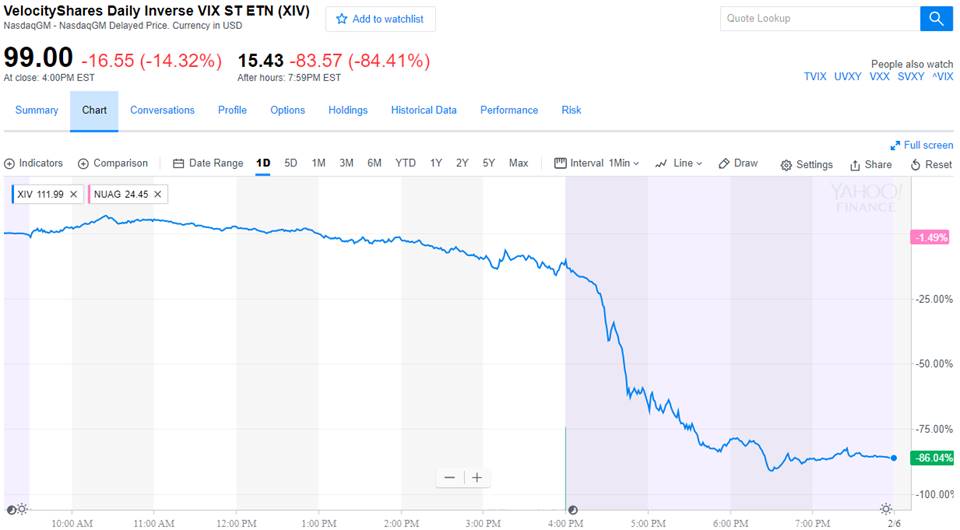

· From a technical standpoint, for the traders, computer algorithms, and funds that follow chart trends and more numerical data points on the market, the damage done by the above created multiple “sell” signals. I won’t get into “Dow Theory”, broken trend lines, violated moving averages, “death crosses”, and broken long-term support. Suffice it to say that a segment of the market has decided it’s safer to sell than to buy or hold at this point and they are doing so quickly and at any price. This cycle of losses triggering more selling probably triggers margin calls, hedge fund liquidations, and more forced selling which takes a while to clear through the market. It often takes prices well below fair value for sidelined buyers to step in, break the cycle, reverse the trend, and flip all those technical indicators back to “buy” signals.

The potential good news is that we’ve hit some extremes on sentiment that can be viewed as exhaustion points for selling. This is based on the idea that when everyone in the world has become bearish and has sold, there is no one left to sell and markets bottom. Think March, 2009. Over the last few days we experienced the following:

· The CBOE put/call ratio hit an all-time high. That means that substantially more bearish bets were being made through the options market than bullish ones. So much so that the level of downside bets to upside bets exceeds recorded history.

· The CNN Fear & Greed Index hit 3 (on a 0-100 scale with 0 being the most fear and 100 being the most greed). The index hasn’t been around for that long, but I don’t remember ever seeing it that low.

· The AAII Investor Sentiment Survey results show that only 25% of people are bullish with over 47% bearing (almost the exact opposite of the start of Q4). They note that “Optimism and pessimism remain outside their typical ranges: bullish sentiment is unusually low and bearish is unusually high. Historically, both have been followed by higher-than-median six- and 12-month returns for the S&P 500 index, particularly unusually low optimism.“

· The VIX, Wall Street’s fear gauge that is based on the annualized expected change in the S&P 500 based on short-term options pricing hit 30. That implies an annualized 30% move, up or down, in the S&P 500. While it can certainly go higher, market average is in the 15-20 range and last year at this time it was below 10. It tends to spike when fear is high and short-term traders are buying options and willing to pay a hefty price to hedge their portfolio positions.

· The SKEW index, which shows the relative price of out-of-the-money puts (bets that the market will drop big) to out-of-the-money calls (bets the market will rise big) has finally started to move up from a multi-year low. The complacency that had crept into the market, even through the October declines, is finally waning.

I’m not saying the drop is over and prices will snap back. It remains to be seen what the economy actually does in 2019 and how monetary policy and fiscal policy evolve as a result. We’re nowhere near what happened in 2002-2003 or 2008-2009 and I’ve told all of you many times to prepare to lose 50% of the money that you have in stocks at some point during your lifetime. This could be it. Or it could not be. The market is always correct and I think it has correctly priced in the known risks and more importantly, the risk of the unknown heading into the next couple of years. Selling has been extreme, but that doesn’t mean it has been “overdone” simply because of extreme indicators, nor does it mean that this is just the beginning of the decline, simply because uptrends have been broken and Dow Theory says it is. We have continued to harvest losses for tax purposes where appropriate and to rebalance portfolios back to their target stock/bond weightings. If stocks continue to fall, there will be more of this. If they don’t, then our rebalancing actions of selling bonds and buying stocks (the reverse of what we’ve been doing during the bull market) create the perfect buy low / sell high rhythm, while keeping portfolio risk levels and return targets in sync with client goals.

There is no doubt that losses cause pain. We all work hard for our money and hate to see it evaporate in a market decline. There is no way to earn equity returns over the long term though without being willing to live through the declines. If there were no risks in stocks, they would pay 2% as FDIC-insured bank accounts do. We investors signed up for this risk and if nothing else, we should take solace in the fact that lower prices are a good thing when you’re a buyer. We should also remember that there have been thousands of crises, recessions, political upheavals, natural disasters, wars, and plagues. It’s not a coincidence that even after all of that, we were recently at all-time highs with all-time high global population and all-time high measures of productivity. Humans will continue to worry and humans will continue to create better lives for themselves and their children. This (the current downturn) too shall pass.

If you’re reading this as a PWA client and have questions or want to discuss your individual portfolio, goals, etc., as always, please don’t hesitate to contact me. I hope you all have a wonderful holiday season filled with friends, family, and fun.