This is a Q&A-style primer for the 2024 election. I went with a potentially triggering title intentionally, because that’s what we’re used to on anything election-focused. Rest assured, I’m not warning about anything financially dreadful that is likely to occur as a result of the upcoming election.

Q: What is the “Election Warning” about then?

A: It’s a warning about possible emotional reactions to the results, delays in the results, or financial market volatility around the results of the election. We’re all human. We all panic sometimes. We all make decisions in the midst of a panic. My hope is that by acknowledging this in advance, we can invite logic and calm to the part of the brain that feeds off anxiety. We’re one day out from what the candidates and the media would have you believe is THE MOST IMPORTANT ELECTION OF ALL-TIME. That very well may be the case, especially if things you highly value are at risk of changing or things you’re strongly against are at risk of not changing. I would just note that virtually every presidential election and many mid-term elections are presented as THE MOST IMPORTANT ELECTION OF ALL-TIME. The candidates want you involved to increase the odds that you will donate and ultimately vote. The media wants you interested to increase the odds that you tune in, read, or click (which leads to advertising or subscription revenue). The entire process is designed to put you on edge, especially if you live in a “battleground state” like I do, where we are beaten over the head with divisive, ugly messages for months in advance of the election. There is much at stake that is not financial in nature. I acknowledge that and don’t want to minimize it. But, the anxiety over those non-financial issues can carry over into personal finance, especially if we see markets gyrating due to the same stress-inducing election. A recent poll conducted by the Certified Financial Planning (CFP®) Board, showed that a staggering ~80% of Americans expect their personal finances to deteriorate if their preferred candidate loses the 2024 presidential election. It always feels bad if the other side wins. It’s important to acknowledge that our biases play more of a role in feeling that an election will be financially negative than historical facts do. Here’s another example:

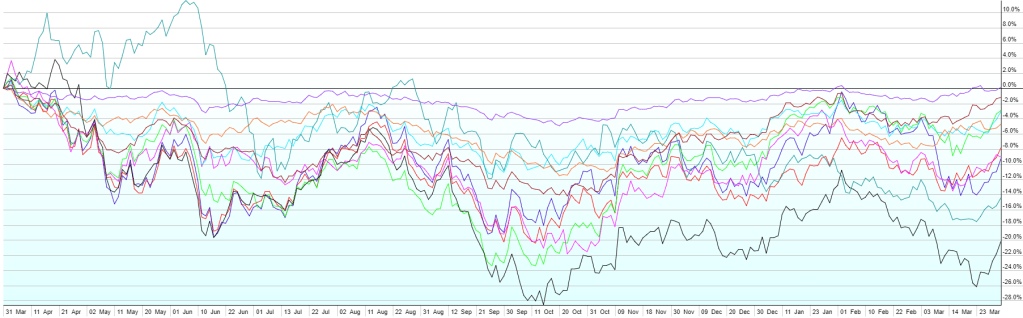

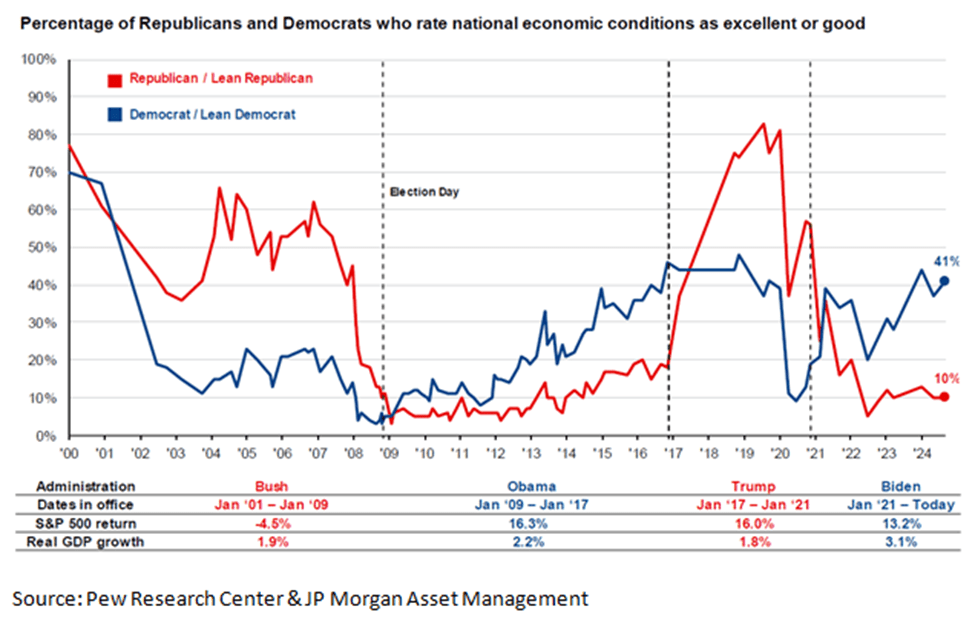

Regardless of your party affiliation, if the President comes from the party that you lean toward, you’re much more likely to have a positive view of economic conditions than if the other party is in power. The effect takes hold very shortly after election day, so it’s not the impact of actual policy changes or legislation driving this result. It’s our biased view of what’s to come.

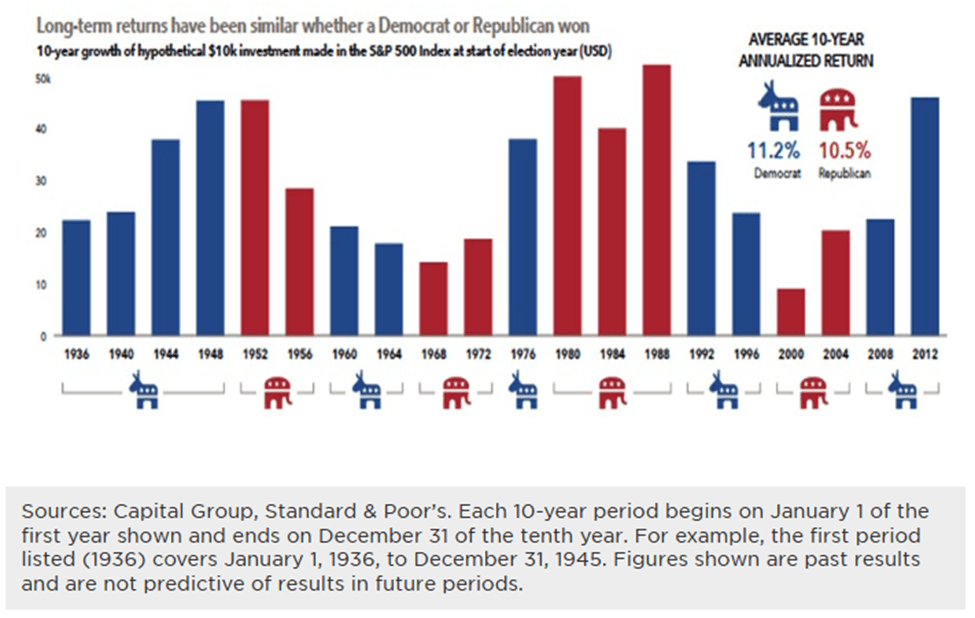

Q: Isn’t it better for the stock market if one side wins than the other?

A: I haven’t seen any evidence that would lead me to a conclusion one way or the other.

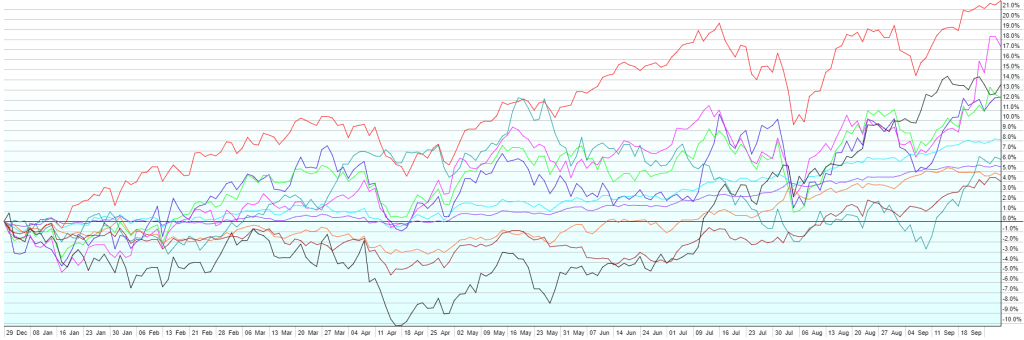

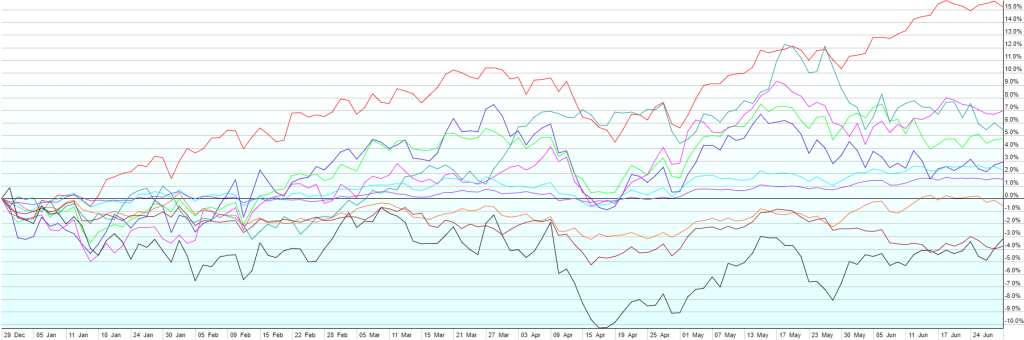

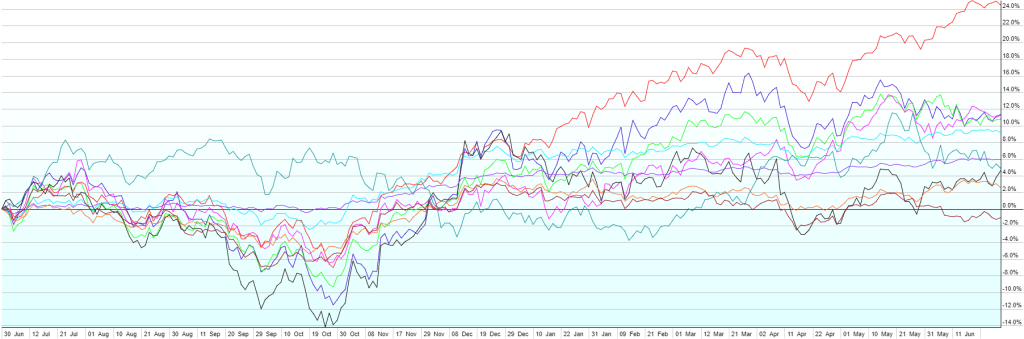

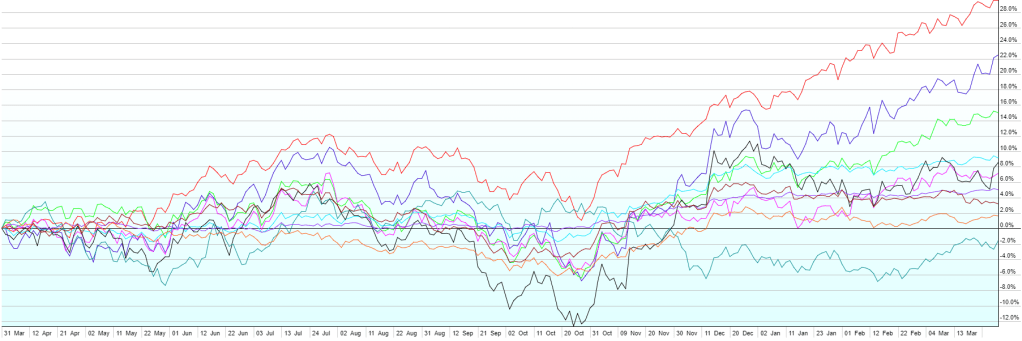

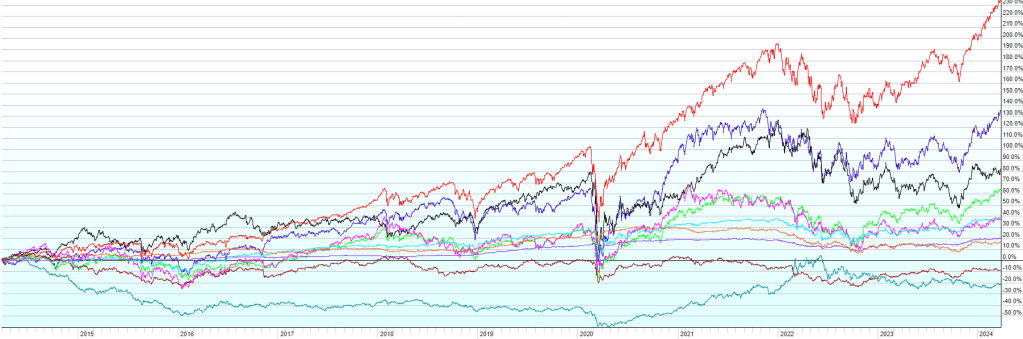

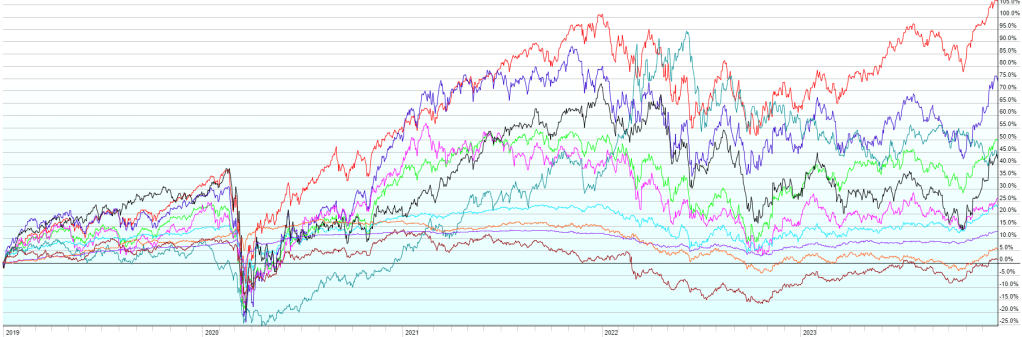

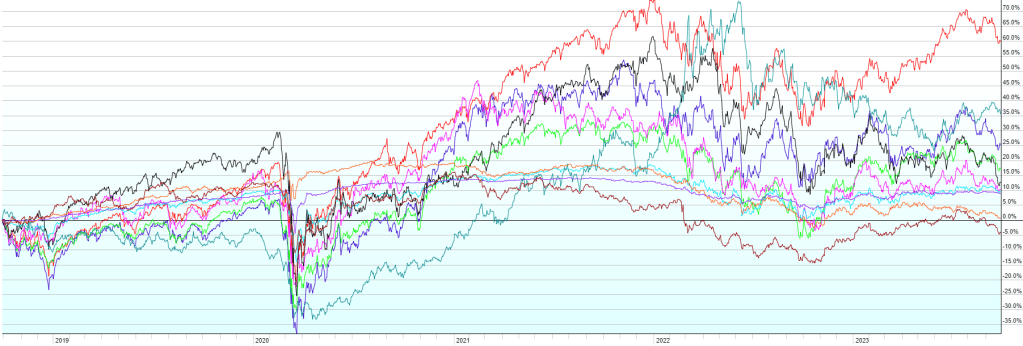

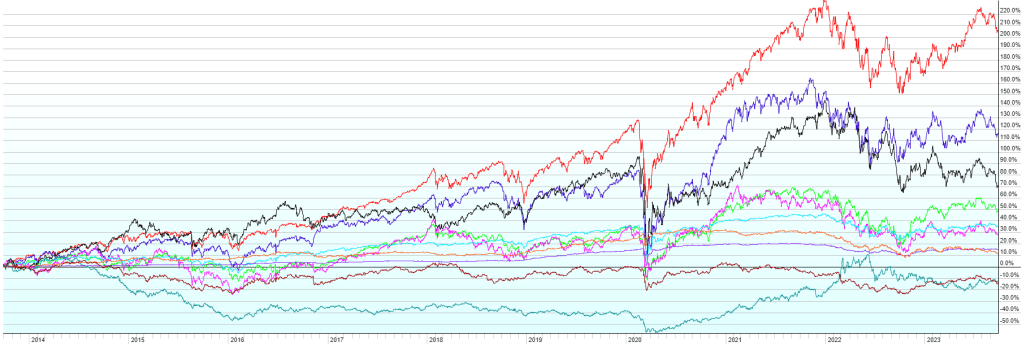

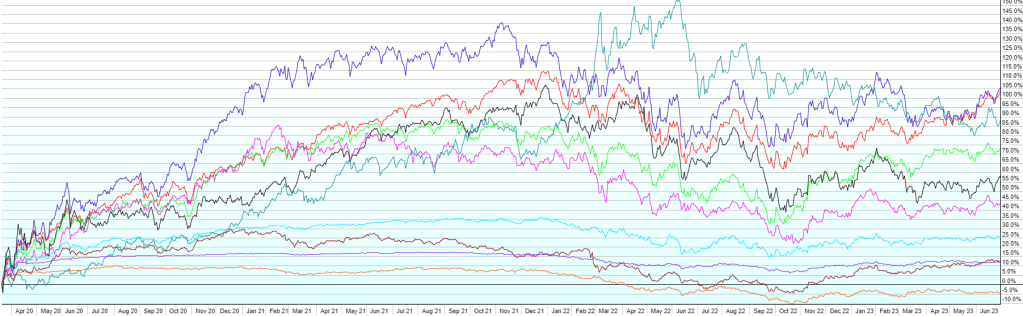

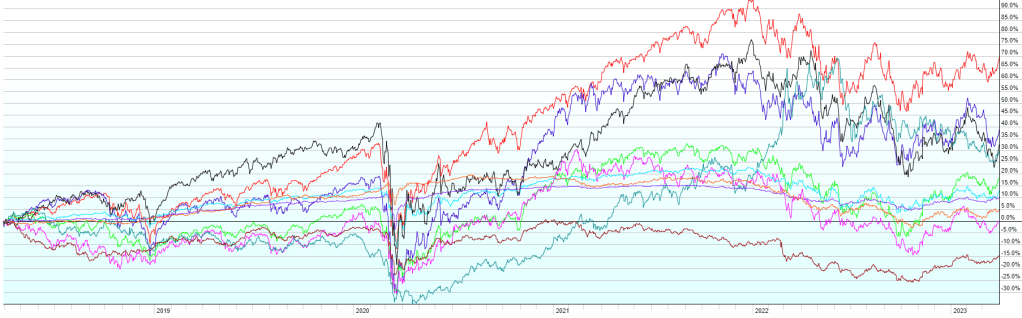

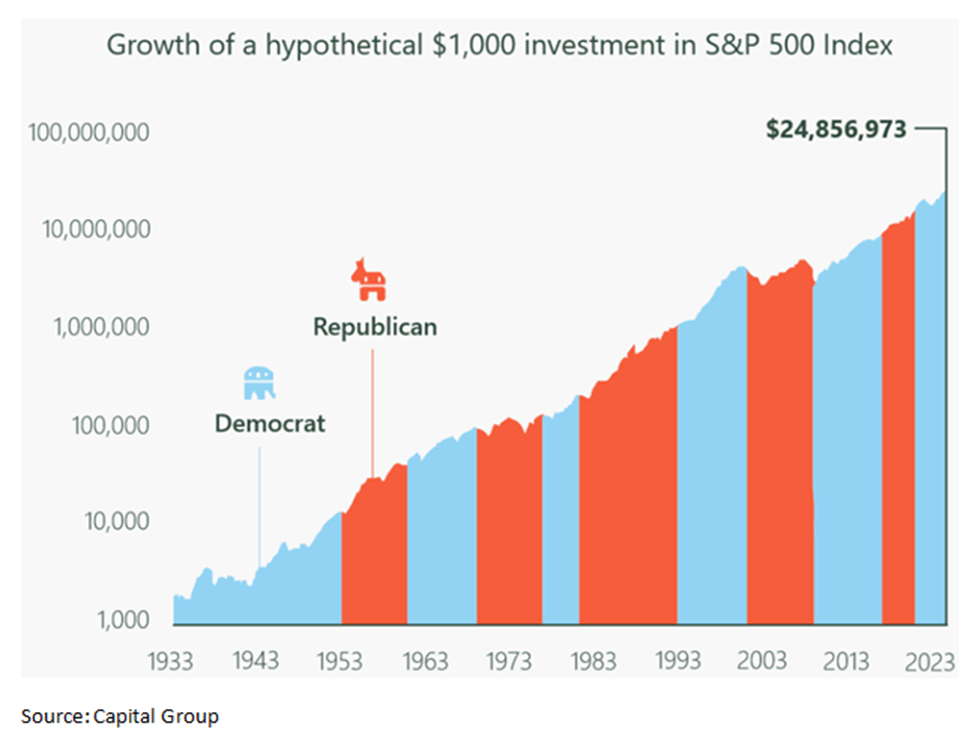

The one thing that is very clear is that stocks tend to go up and the economy tends to grow over the long-term, regardless of who is in the White House.

Note the scale on the left of the chart is not linear. Sure, there are dips here and there, but the takeaway should be clear… over 90 years and through multiple presidents from both parties, a $1000 investment in the S&P 500 grew almost 25,000x to nearly $25M. I went back and checked that because it seemed like maybe a typo. It’s not. It’s the stunning power of compound growth over a long period of time. Instead of worrying about the relatively small dips in the rollercoaster, we just need to zoom out and focus on the extreme upward-sloping ride.

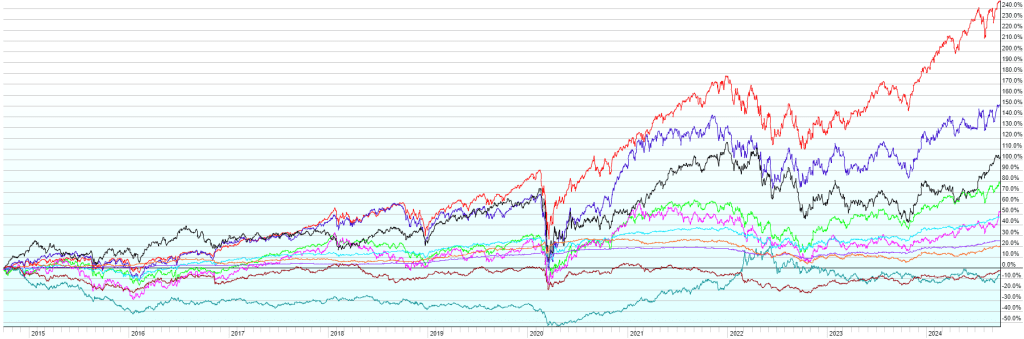

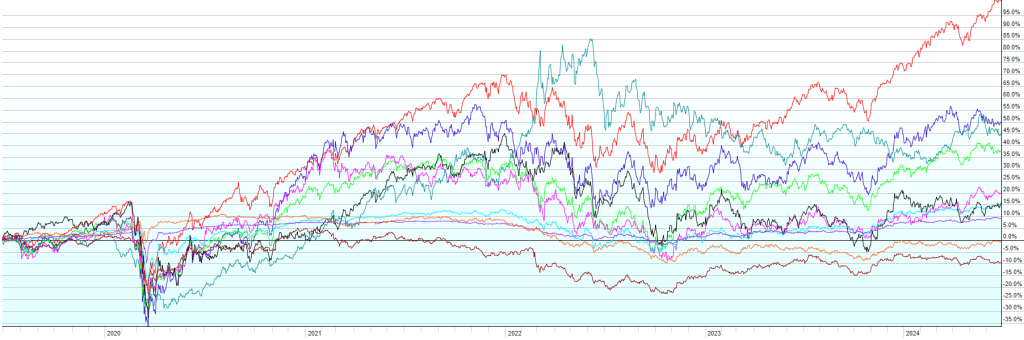

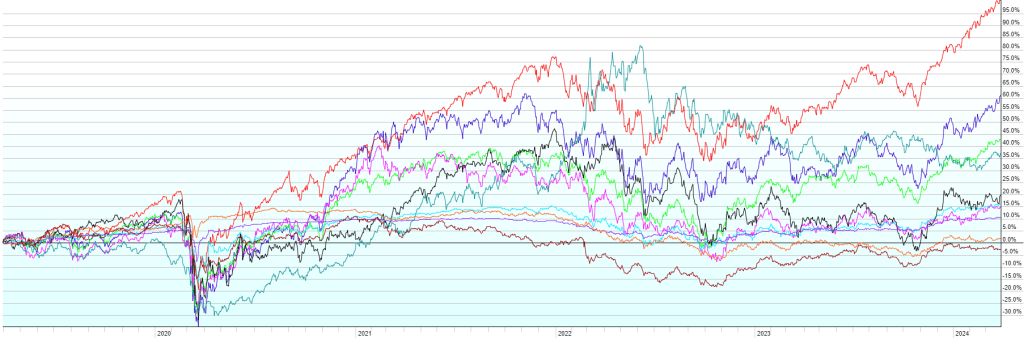

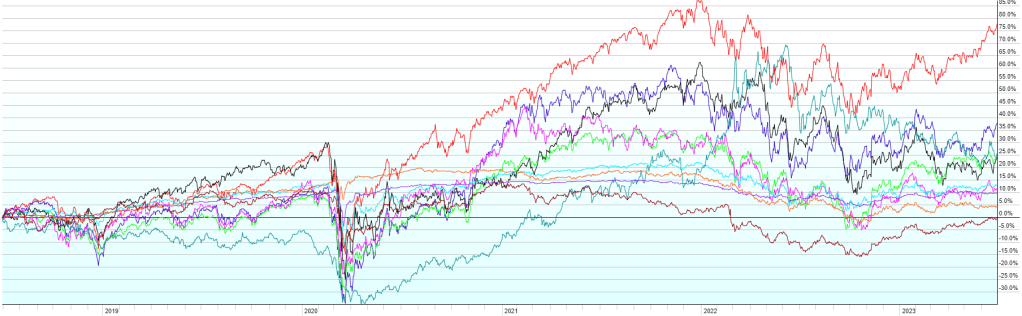

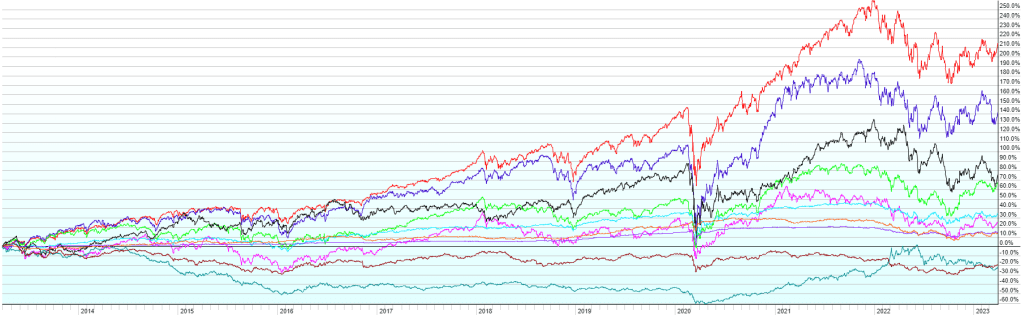

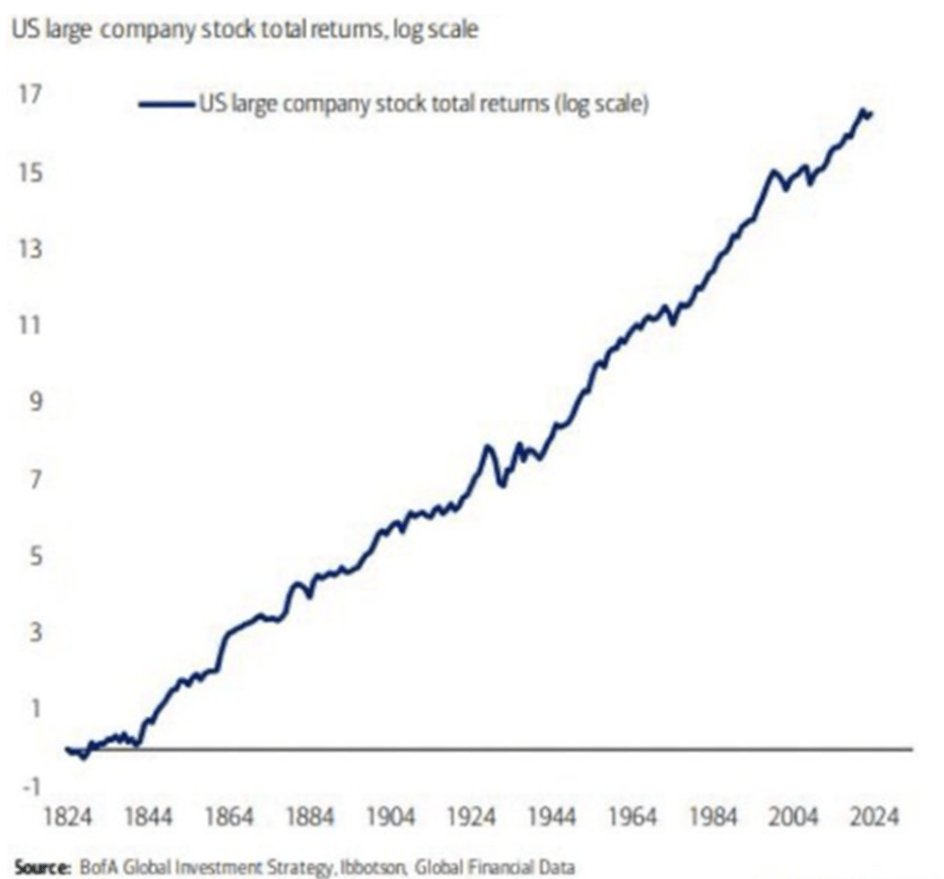

Q: That chart starts just after the Great Depression though. Wouldn’t including that change things?

A: Thanks to Ibbotson Global Financial Data and BofA, we can take this data back to pre-Civil War times and it’s even more impressive. The chart below shows the growth of large US companies for 200 years on a logarithmic scale. That means the values didn’t grow from 0 to 17x over that period. They grew 10^17th times, or 1,000,000,000,000,000,000x! Population growth, productivity growth, and inflation just simply swamp all the minutia over time. You can see the Great Depression on the chart. Notably, you can also see that it mostly just brought growth back in line with the historical trend.

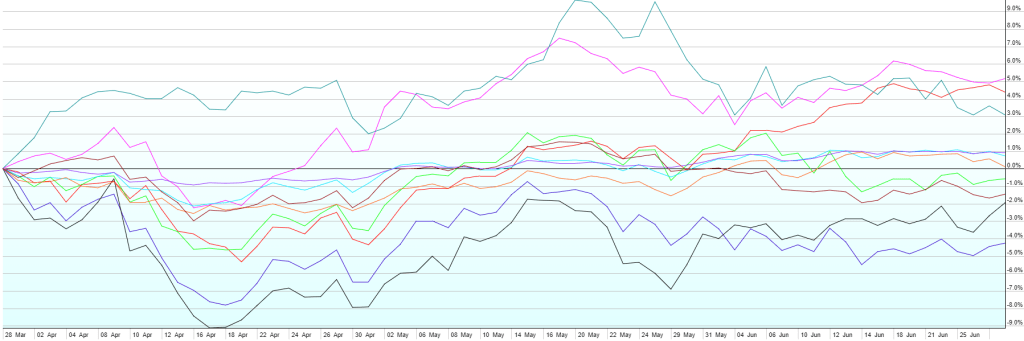

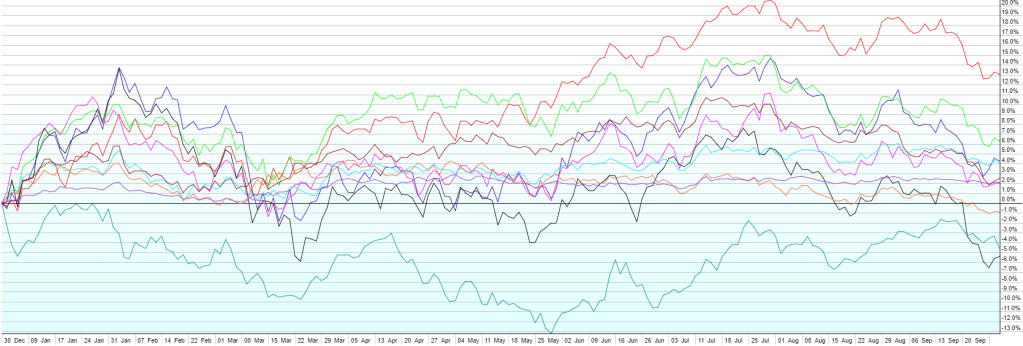

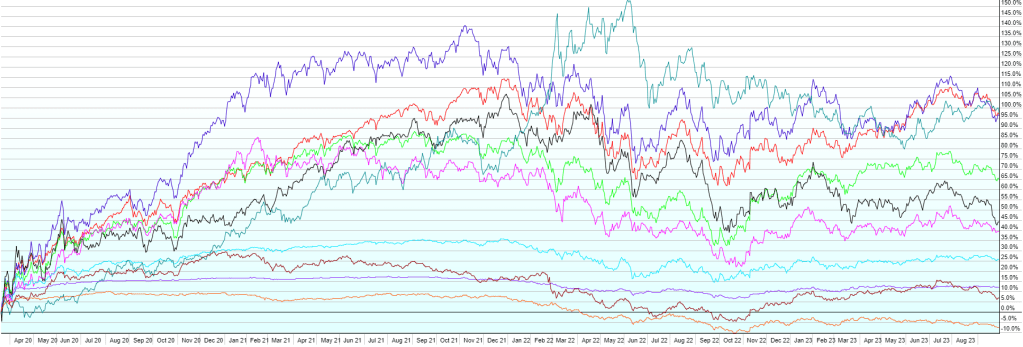

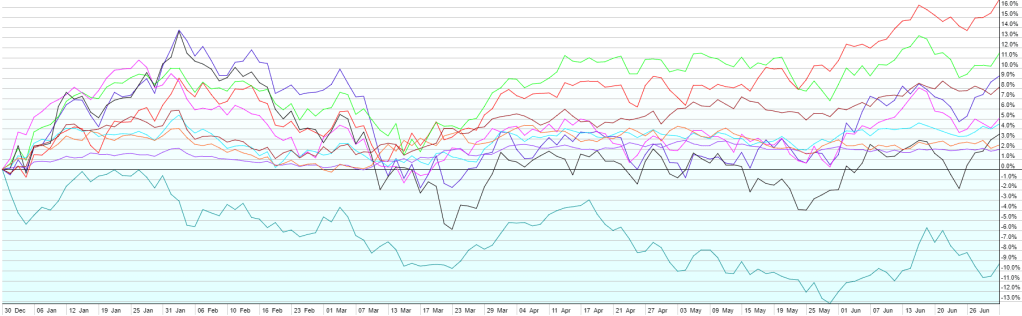

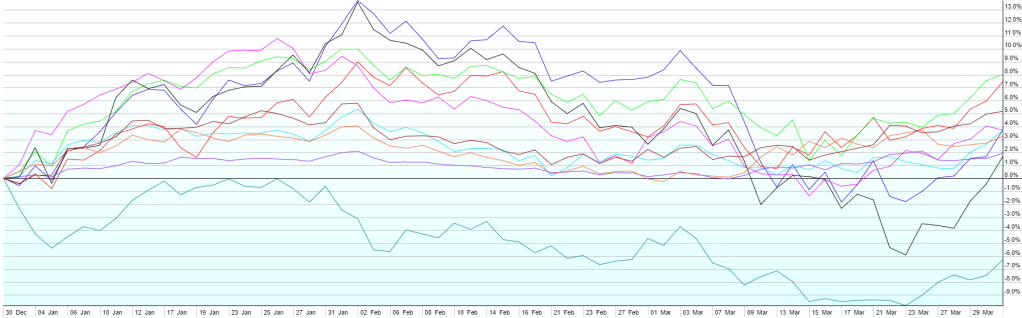

Q: What about the short-term?

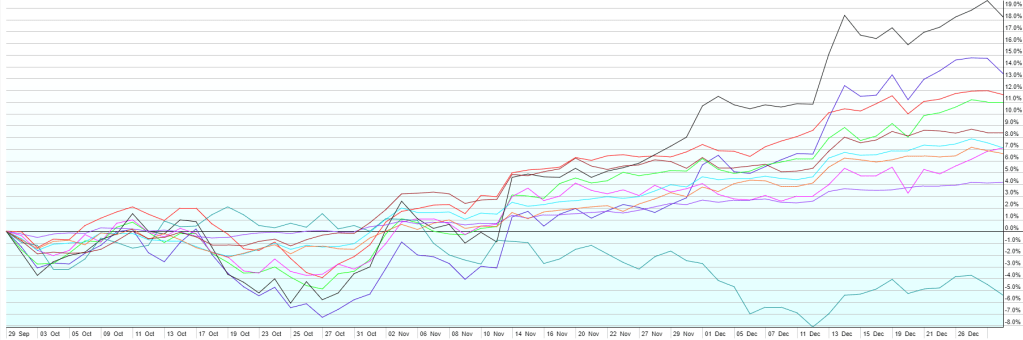

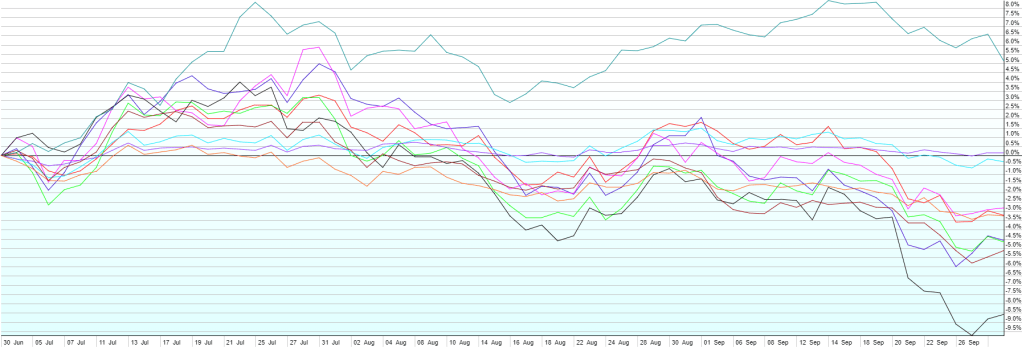

A: If you’re invested in stocks for the short-term, you’re just gambling. That doesn’t make sense. Either money is needed for the short-term and shouldn’t be primarily invested in stocks or money isn’t needed for the short-term and the short-term doesn’t matter. It is fair to guess that the stock and bond markets will be volatile as election results come in, especially if election results are delayed. There is an old market adage that states that markets hate uncertainty. Peak uncertainty, from a political perspective, will take place just as polls are closing on election night. Slowly, the uncertainty will be drained from the system and the market will price in victory for one of the candidates, with their likely policy platform, probability adjusted for the odds that it can move through Congress.

Even sector-based predictions are tough to make based on who is president. Richard Berstein recently pointed out that Energy has been the best-performing sector during Biden’s presidency and the Emerging Markets outperformed US Small Caps during Trump’s. Pundits would typically forecast the exact opposite.

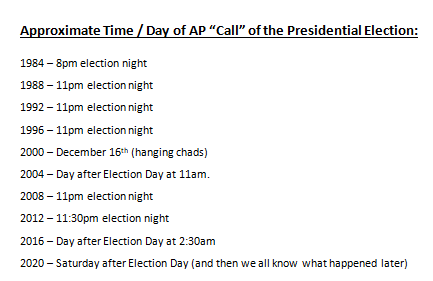

Q: How slowly will that uncertainty be drained? When should we expect election results:

A: We can look back at previous presidential elections for clues:

We can also look at how states count ballots, when polls close, and what the news outlets expect in the battleground states:

My notes on ballot counting, by state:

- Arizona – multiple referendums, long ballot, lots of manual counting likely needed. Delay could be several days.

- Georgia – fairly quick count, but possibly misleading start. Mail-in ballot counting starts at 7am on election day, so the first report will be mostly those ballots, which have historically skewed Democratic. That means a Harris early lead, with Trump closing the gap as more ballots are counted is likely.

- Michigan – counted about 45% of the vote by midnight in 2020. Likely to be a close race, so almost definitely won’t be decided election night. Most of the vote should be counted by Wednesday (~95% per NBC News)

- Nevada – mails ballots to all active voters. Allows mail-in ballots to be received and counted up to Nov 9. In a close race, results will be delayed at least a few days.

- North Carolina – usually a quick count, but storm damage may slow that a bit this year. In 2020, 99% of votes were counted by midnight. Like GA, starts count of mail ballots early in the day, so early results may show a skewed count. Nash County should be the first of ten counties in battleground states that flipped from Trump in 2016 to Biden in 2020 to complete their count around 10pm on election night. Some will view this an early indicator of the 2024 trend. New Hanover is another flip county, expected to complete its count around 10:30pm.

- Pennsylvania – can’t start counting mail-in ballots until the polls close. Almost 25% of the votes were mail-in in 2022. However, a lot of investment through the state in making the process better than in 2020 (new machines, more workers, etc.). NBC News expects 98-99% of the vote counted by Wednesday morning.

- Wisconsin – fast in the small counties, slower in the large ones which means a possible skewed early lead for Trump given the big city votes should skew Democratic. ~70% of the 2020 vote was in by midnight. Most should be counted by Wednesday (~99% expected per NBC News).

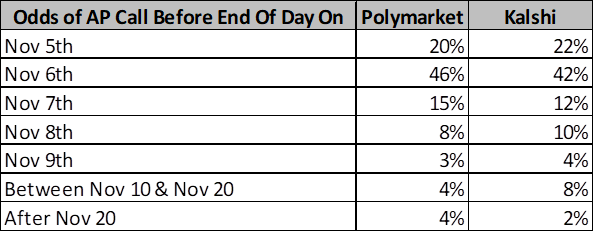

Finally, we can look at prediction markets where real people have real money on the expected result. Here are the odds of when the race will be called:

While I suppose anything can happen, especially after having lived through 2020, Mid-December seems to be the latest possible date of certainty. Under electoral reforms passed after the 2020 election, individual states need to resolve disputes about their results by Dec. 11. If they can’t, the Supreme Court will settle them instead. The Electoral College is scheduled to vote on Dec. 17, which will formalize the result. My opinion: if it’s a blowout, election night is possible, but that seems unlikely given how close the race is (see below). If not, Wed, 11/6 seems most likely. There is potential for it to take several more days, if the race is close and battleground states need recounts or exact counts of all absentee ballots. I think we’ll be pretty certain who won by the end of day on Wednesday, even if the AP hasn’t officially called the race.

Q: You mentioned the market probability adjusts the odds that the winner’s platform can move through Congress. What are the chances the President will be able to do anything at all?

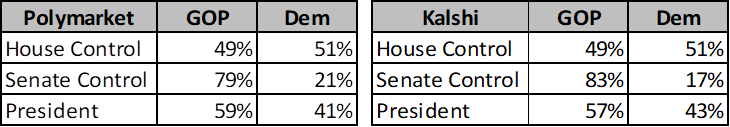

A: The odds are obviously highest if one party controls the presidency and both chambers of Congress. In an atmosphere as divisive as we currently have, it’s unlikely that much will change from current law, at least not without a lot of compromise, if there is a power split. Currently, prediction markets give the following odds:

Results are likely to be correlated though. For example, if Democrats outperformed expectations and won the Senate despite only a 21% chance of doing so, it’s almost certain that they also won the presidency and the House. So, the overall chance of full control by each party is somewhat unintuitive from the results above. Since Kalshi has this market available, we can see what’s expected:

Q: What are the differences between the two candidates’ policy positions that might impact the economy, financial markets, and taxes?

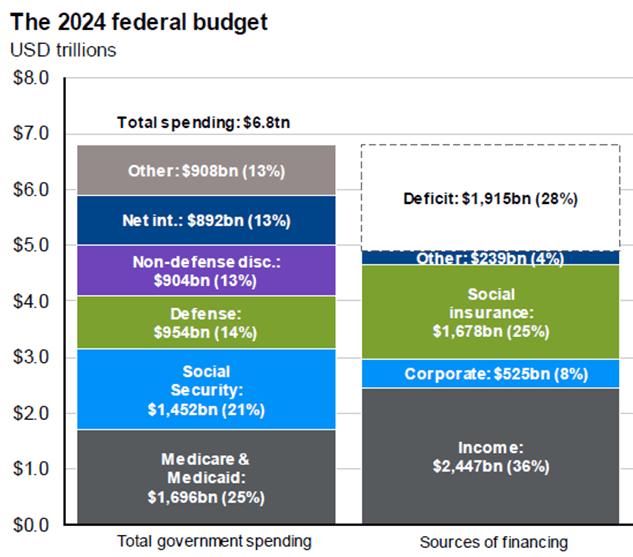

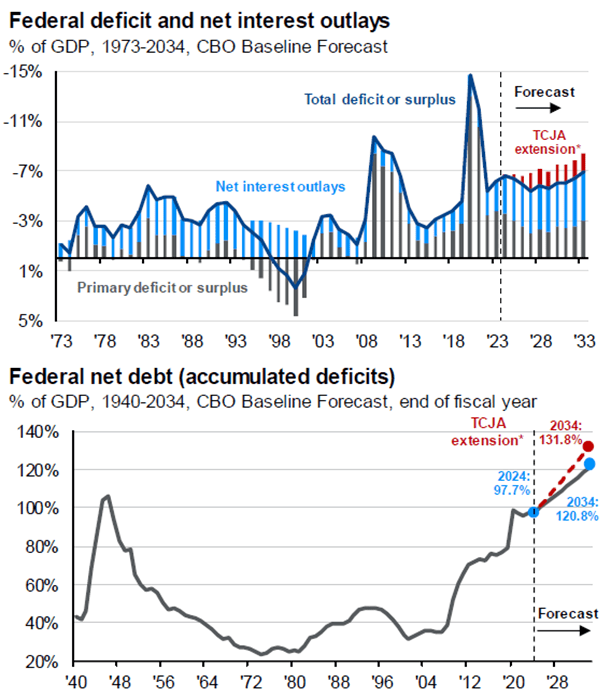

A: A lot of this comes down to the expiration of most of the provisions of the Tax Cuts & Jobs Act (“TCJA”) at the end of 2025. That will happen as the default, i.e. if no new legislation is passed. Notably, the one major provision of TCJA that will not expire in 2025 is the corporate tax rate, currently set to 21%. It would take new legislation to change that.

If Republicans sweep, we may see an extension of the full TCJA, perhaps with even lower individual tax rates, and some provisions made permanent. We would likely see more tariffs on foreign goods as a partial Federal revenue raiser, but overall, we’d likely run higher deficits. If deportations of those who entered the country illegally take place on a mass scale, we may see a labor shortage. Combined with tariffs, this could lead to another bout of inflation. Trump has also suggested no income tax on tips, a deduction for auto loan payments, tax-free overtime and Social Security, ending income tax on citizens living abroad, and a host of other nearly impossible-to-pass and administer provisions, even with full control. The corporate tax rate would almost definitely not increase and could decrease further.

If Democrats sweep, we’d almost definitely see many provisions of the TCJA expire. That means higher tax rates, at least on middle-to-upper-income families ($400k/yr in income seems to be the dividing line). It probably means higher taxes on capital gains, higher investment income taxes (Medicare Surtax), and possibly a change that would make death a capital gains realization event, with some exemption. The corporate tax rate would likely increase as well. The higher taxes would help somewhat with deficits, but there would also be an expansion of the Child Tax Credit and possibly more incentives to move toward alternate energy. Overall, the package is likely to be closer to revenue-neutral, meaning the existing deficit might not grow, but it would still exist and drive additional debt.

If power is split, the corporate tax rate would probably stay where it is since a new law to change it would be difficult to pass. Compromise would be needed to prevent TCJA expiration and so we’d wind up with some mix of higher tax rates, and an expanded child tax credit, but probably no changes to capital gains or investment income tax.

As you can see from the above, there are pluses and minuses in all cases. The only consistent theme is that we’re likely to continue to borrow a lot of money to fund the Federal government.

Q: Who is going to win?

A: I’ve never been more confident in my conclusion in any previous election. That conclusion: “I don’t know.” On the polling side, things are really close and there are a lot of reasons one could infer that polls are undercounting voters on both sides.

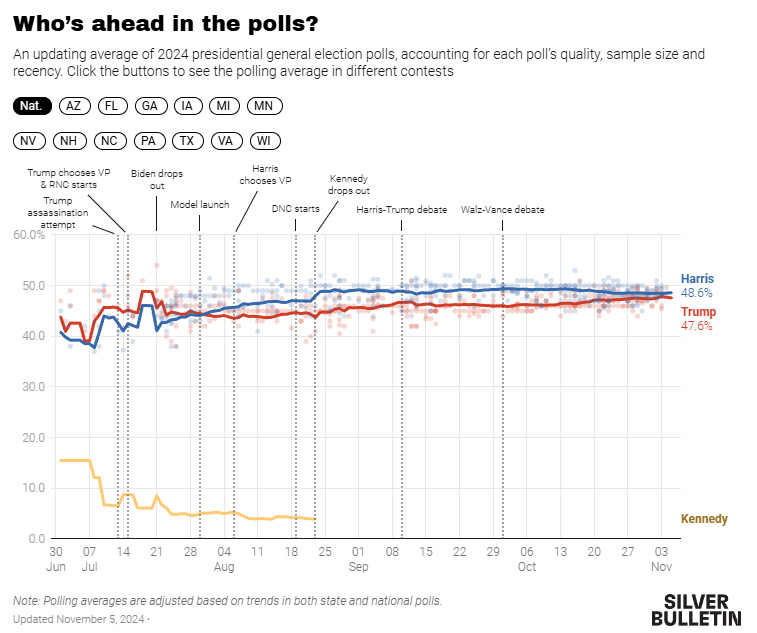

Nate Silver’s “Silver Bulletin” does a rigorous aggregation of the various polls, weighting by previous accuracy, by likely vs. registered voters, and by reported margin of error. He then runs a model that simulates different results based on the polling aggregates as well as economic and demographic data and uses the simulation to determine the probability of each possible result. His conclusion, as of 12:30am on Election Day Morning, after pouring through an insane amount of statistical data, was that Harris had a 50.015% chance of winning the election to Trump’s 49.985%. We can’t get much closer than that.

Prediction markets have Trump further ahead, but with some wild gyrations over the past several days. His lead on Polymarket has been as high as 67-33, but currently sits at 59.7-40.3. Kalshi favors Harris slightly more, with Trump ahead 57-43. PredictIt, an older prediction market that imposes fairly small position limits, has a 50-50 tie.

I’ve been following an aggregator called The Super Model, which attempts to put this all together and come up with a weighted total forecast. They have Trump up 56-44.

My take: this is just too close to call. That doesn’t necessarily mean the election will be won by a small margin. It just means that the predictive data we have available doesn’t reveal a conclusion with any level of confidence. The probability margins we’re talking about are equivalent to a 1.5 point spread in a football game. It doesn’t mean the score is necessarily going to be that close, but that’s how close fair odds would be going in.

In summary, we’ll know a lot more in a couple of days about the politics of the next four years. Regardless of the stock market’s short-term reaction, none of it is likely to outweigh the long-term economic growth potential of the US economy. If you feel any election-induced anxiety about financial markets or your financial plan, try to zoom out to the big picture and the long-term. There isn’t a result I can forecast that would lead to me issuing an “Election Warning” for your finances. The 2024 Election will come and go like all the previous ones. And then we’ll start hearing about the MOST IMPORTANT ELECTIONS OF ALL TIME to come in 2026 and 2028.