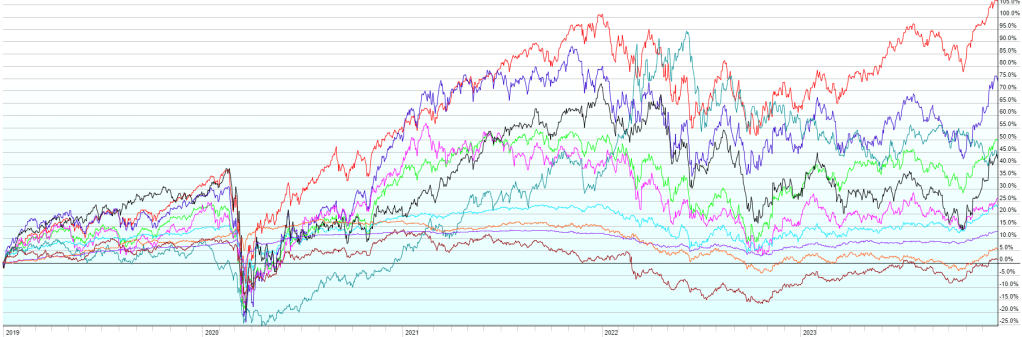

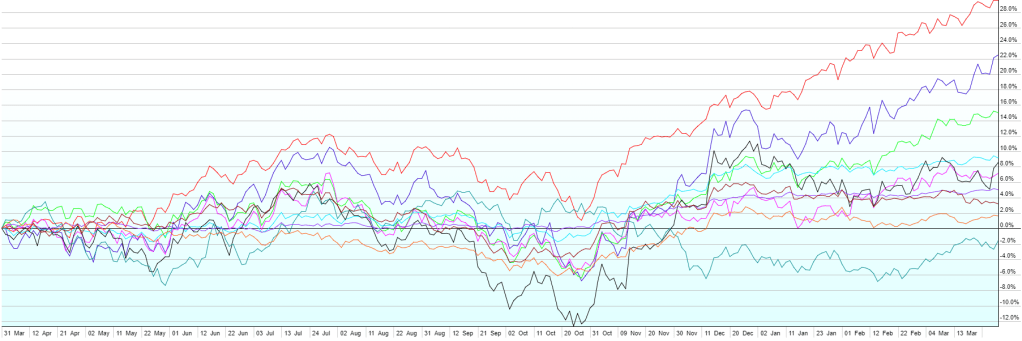

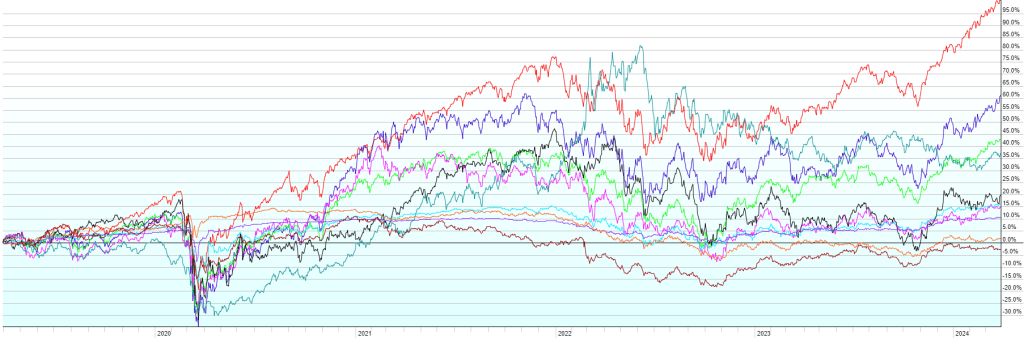

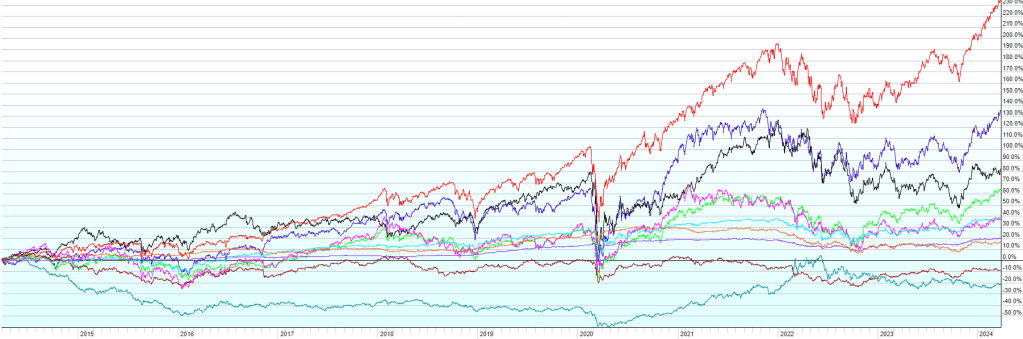

This post contains the usual returns by asset class for this past quarter (by representative ETF), last 12 months, last five years, last ten years, and since the covid low (3/23/2020). While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

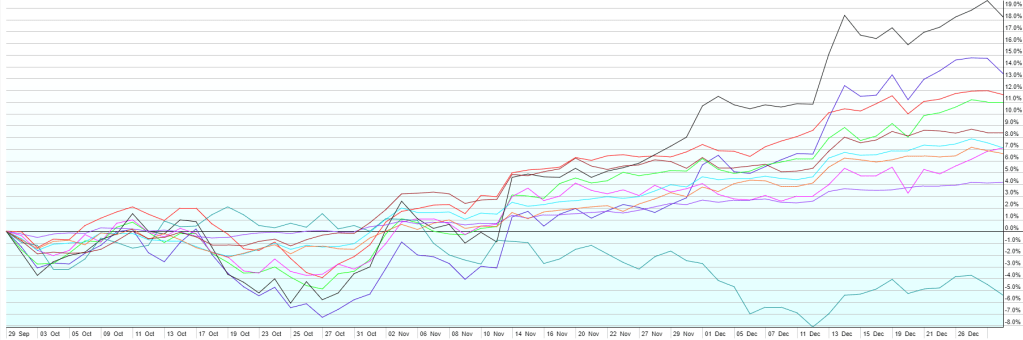

A steadying of inflation at a level higher than the Fed’s 2% target pushed back market expectations for interest rate cuts in the first half of 2024. This led to higher rates across the yield curve in Q1, putting some pressure on bonds. Stocks though, looked through higher interest rates and saw an economy that continues to chug along and defy 7% mortgage rates, higher than acceptable inflation, and a massive debt load. US Large Cap stocks (+10.4%) dominated once again, with seemingly relentless buying led by the big Artificial Intelligence (AI) names like Nvidia. US Small Caps weren’t far behind with a 7.5% gain. International stocks underperformed the US, but still saw good growth for the quarter with Developed countries up 5.4% and Emerging Markets up 1.7%. Commodities saw some strength as well, up 2.3%, and high-yield (junk) bonds were up 1.5% despite rising interest rates, due to their higher interest payments and spread compression vs. other, safer debt like Treasuries. Short-term Corporate Bonds were up 0.6%, fairing better than higher duration bonds as rates rose. Aggregate US Bonds lost 0.7%, Real Estate Investment Trusts were down 1.3% and Emerging Market Local Currency Bonds lost 2.4% for the quarter thanks to higher rates and a stronger dollar.