I’ve parsed through the legislation (which can be found here if you want to check it out for yourself), as well as a ton of analysis, and to the best of my ability, here’s a quick summary of the relevant portions of the new law that averted the tax portion of the fiscal cliff. Note that while $400k/450k are getting all the press for paying higher taxes, there are a number of provisions which impact $200k(single)/$250k(married), and one really big one that impacts everyone (Payroll Tax Holiday Ended):

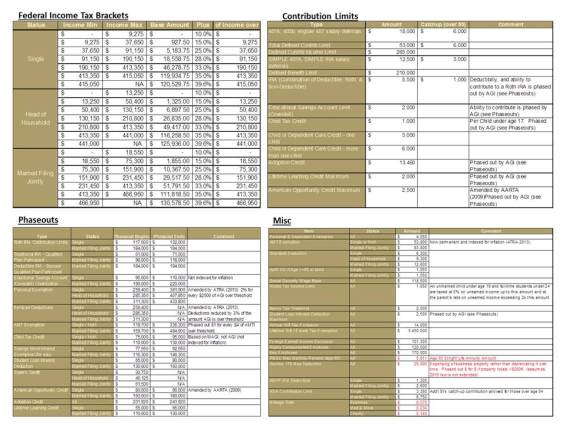

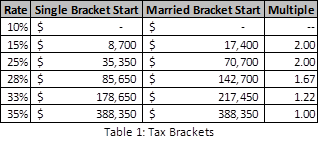

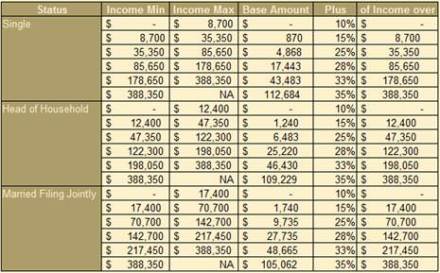

· Income Tax Rates: All existing rates remain the same with brackets increased for inflation (10%, 15%, 25%, 28%, 33%, 35%) and a new 39.6% bracket begins at taxable income over $400k for singles and $450k for joint filers.

· Long-Term Capital Gains: These were set to move from 0% for the bottom two tax brackets and 15% for everyone else to 20% for everyone. The legislation keeps the 0% and 15% rates for everyone except those in the new 39.6% tax bracket. They’ll pay 20% (not including the new Obamacare Medicare Surtax, see below).

· Dividend Rates: These were set to move from 0% for the bottom two tax brackets and 15% for everyone else to ordinary income rates for everyone. The legislation keeps this rate tied to the long-term capital gains rate with the same rules as above.

· Estate Tax Rates & Exemption: Retained the $5M per person exemption (was set to reset to $1M) and kept it portable (each spouse gets $5M instead of the couple getting $10M which forces complicated bypass trusts to be set up to try to use the $5M from the first to die spouse). Set the top tax rate at 40% (up from 2012’s 35%, but down from the 55% to which 2013 was due to revert).

· AMT Exemption: Patched the AMT exemption amount to the 2011 amount, increased for inflation. This was a big one since it was 2012 they were fixing, not 2013. Even better, they permanently fixed this so that each year’s exemption will be indexed to inflation going forward. This means no end of year scramble to get an AMT patched passed each year.

· Phaseout of Itemized Deductions: this was due to happen in 2013 without any new law, but ATRA tweaked the thresholds. If you are Single with AGI over $250k or married with AGI over $300k, your itemized deductions will be reduced by 3% of the amount that your AGI exceeds the threshold, up to a maximum reduction of 80% of your itemized deductions. To simplify, if you’re over the threshold by $10k, you lose $300 of itemized deductions. If you’re over by $100k, you lose $3k.

· Phaseout of Exemptions: this was also due to happen in 2013, but ATRA unified the phaseout level with the Itemized deduction phaseout. If you are Single with AGI over $250k or married with AGI over $300k, your exemptions ($3800 per family member) are reduced by 2% for every $2500 that you’re over the threshold. To simplify, if you’re over by $10k, you lose 8% of your exemptions. If you’re over by $100k, you lose 80% of your exemptions. This can be a pretty big bite.

· Payroll Tax Holiday Ended: this was due to happen in 2011, but was extended for two years and now is finally gone. It impacts everyone with income from work (employment or self-employment) by restoring the employee portion of Social Security (FICA) tax to 6.2% from 4.2%. This means everyone will pay 2% more tax in getting this level back to its pre-2011 setting (which still grossly underfunds Social Security over the long-term).

· Marriage Penalty: The standard deduction for married filers and the 15% tax brackets were due to revert to 1.67x the single amounts. ATRA kept them at 2x the single amount and made that change permanent. There is still a very large marriage penalty in the code anyway, as described here.

· Bonus Depreciation & Higher 1st Year Expensing: For business owners, 50% bonus depreciation on new purchases is extended into 2013 as is the higher limit for immediate expensing of certain purchases (Section 179).

· Misc. Permanent Extensions: Child Tax Credit ($1k per child subject to limits), Exclusion for Employer Provided Tuition Assistance ($5250 tax free reimbursement).

· Misc. Temporary Extensions: American Opportunity Tax Credit (college), teacher’s deduction ($250), exclusion from discharge of debt on primary residence (no income on short-sale or foreclosure), deduction for Mortgage Insurance Premiums, Deduction for State and Local Sales Tax paid (big in no income tax states), Tuition Deduction.

While not included in the ATRA legislation, it’s important to remember that two new fairly large changes also being in 2013 as Obamacare is rolled out. They are:

1) 0.9% Medicare Surtax on earned income (income from work) that exceeds $200k (single) or $250k (married). It’s important to note here that this will cause underwithholding from your employer if you have multiple jobs or are marred and both spouses have income since payroll systems will not realize that your earned income will exceed $200k/250k until you exceed that amount from a single employer.

2) 3.8% Medicare Surtax on investment income (interest, dividends, capital gains, rents collected, passive business income) if your Adjusted Gross Income exceeds $200k (single) or $250k (married). While there is no withholding on most investment income and you’re used to paying tax when filing or making estimated tax payments on that income through the year, the 3.8% additional tax effectively raises the tax rates on interest, dividends, gains, etc., even if you don’t meet the now well-publicized $400k (single) / $450k (married) income from the fiscal cliff deal.

I have no doubt that more tax changes will come in 2013 and/or 2014 since ATRA only reduces the > $1 trillion deficit by ~$60 billion per year, so it’s hard to count on anything above as permanent even where legislation made it permanent. The next major debate, likely to be more focused on spending than taxes will be in February as the Debt Ceiling will need to be raised again at that time. It’s quite possible that taxes, especially beyond 2013, become part of that negotiation as well.