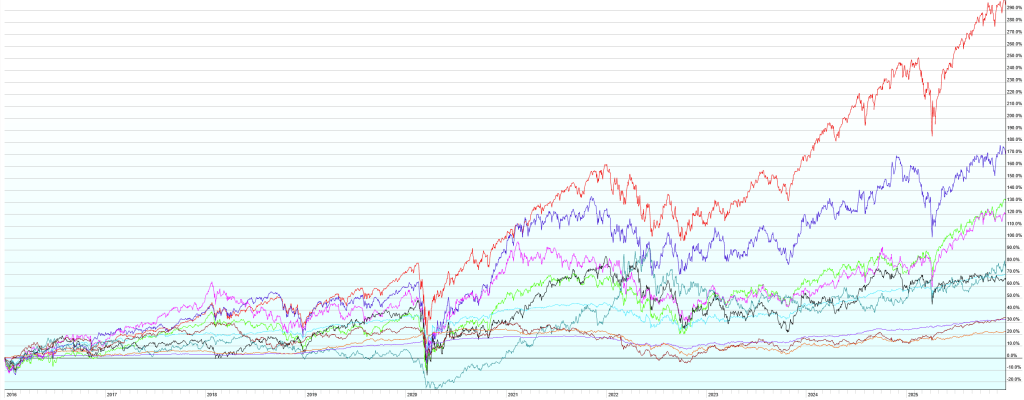

This post contains the usual returns by asset class for this past quarter (by representative ETF), last 12 months, last five years, and last ten years. While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

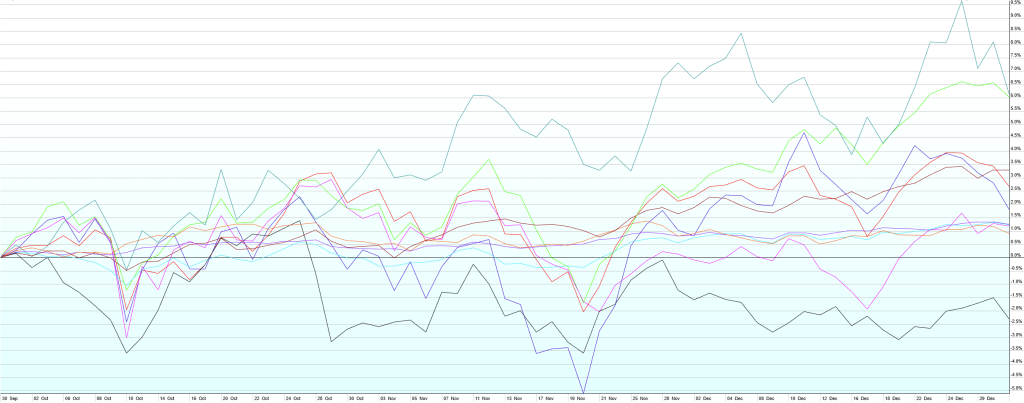

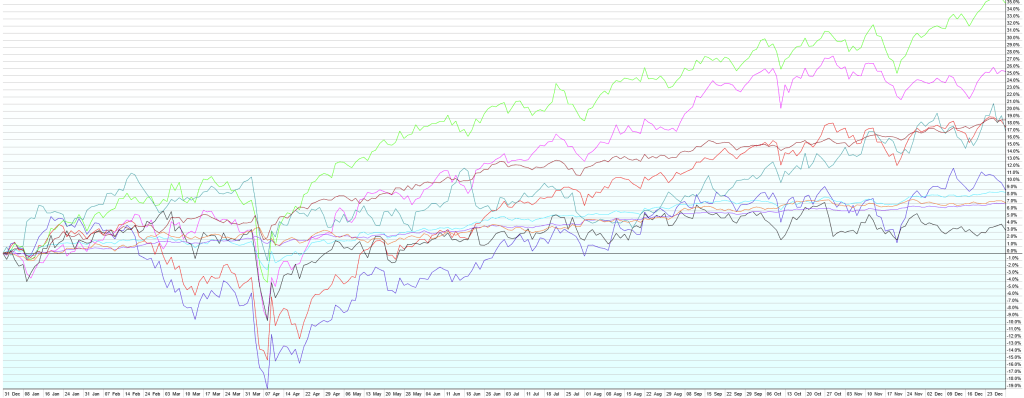

Financial markets continued with another quarter for good returns across all major asset classes with the exception of real estate. The quarter was led by Commodities (+6.1%) and Foreign Developed Stocks (+6.0%), followed by Emerging Market Bonds (+3.3%), US Large Caps (+2.7%), US Small Caps (+1.8%), US Short Term Corporate Bonds (+1.2%), US High-Yield Bonds (+1.2%), Emerging Market Stocks (+1.2%), and US Aggregate Bonds (+0.9%). US Real Estate Investment Trusts (REITs) were the laggards (-2.4%). All major asset classes were up for 2025 as a whole, despite the post-“Liberation Day” plunge. During Q4, as expected, the Fed cut overnight interest rates two more times (now 3.5-3.75%) as inflation continues to ease and job growth has mostly stalled. The market expects another one-to-three quarter-point cuts in 2026.