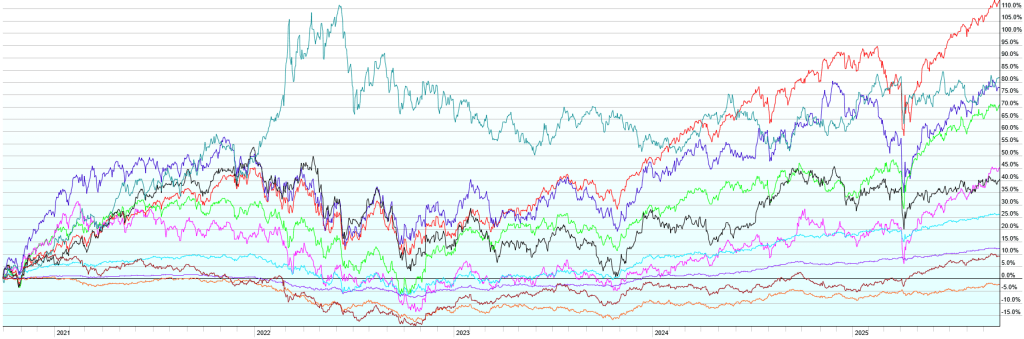

This post contains the usual returns by asset class for this past quarter (by representative ETF), year-to-date, last 12 months, last five years, and last ten years. While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

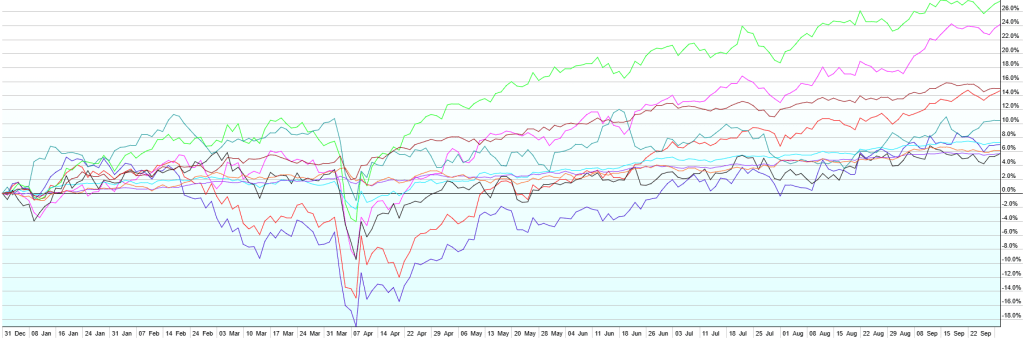

Q3 2025 was another solid quarter for investment returns, with all major asset classes finishing in the green. The quarter was led by Emerging Market Stocks (+10.1%), followed by US Large Caps (+8.1%), US Small Caps (+7.6%), Foreign Developed (+5.6%), Commodities (+4% after a mid-quarter dip), US Real Estate Investment Trusts (REITs) (+3.6%), Emerging Market Bonds (+2.2%), US High-Yield Bonds (+2.1%), US Aggregate Bonds (+2%), and US Short Term Corporate Bonds (+1.7%). During Q3, Congress passed and the president signed the One Big Beautiful Bill (OBBB) Act. More on that here. The Fed also started a new rate cutting cycle with a quarter point cut to 4-4.25% as inflation has eased while the job market has softened a bit. They insist this isn’t a sign of bad things to come, but is instead moving rates back toward neutral from their current, somewhat restrictive level. Markets expect another two quarter-point cuts before the end of the year.