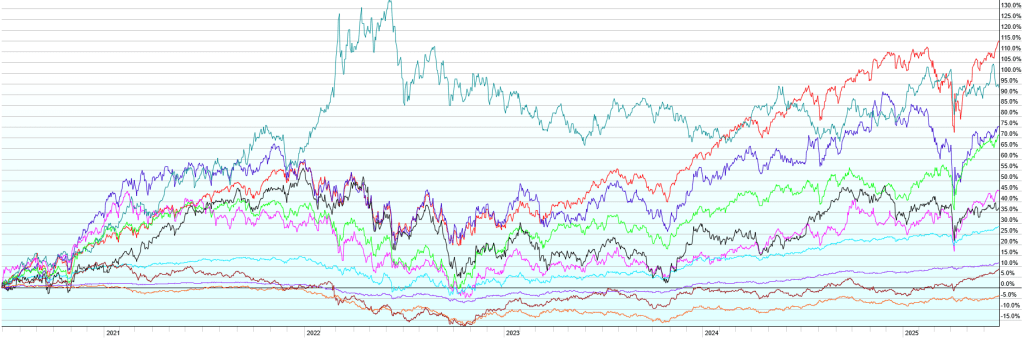

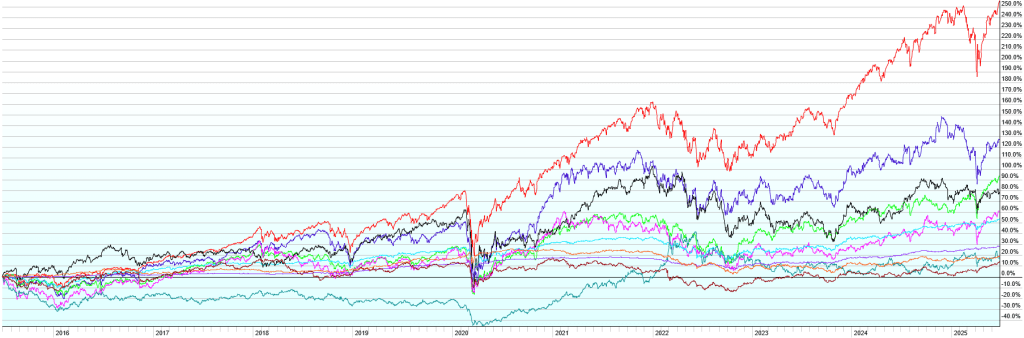

This post contains the usual returns by asset class for this past quarter (by representative ETF), year-to-date, last 12 months, last five years, and last ten years. While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

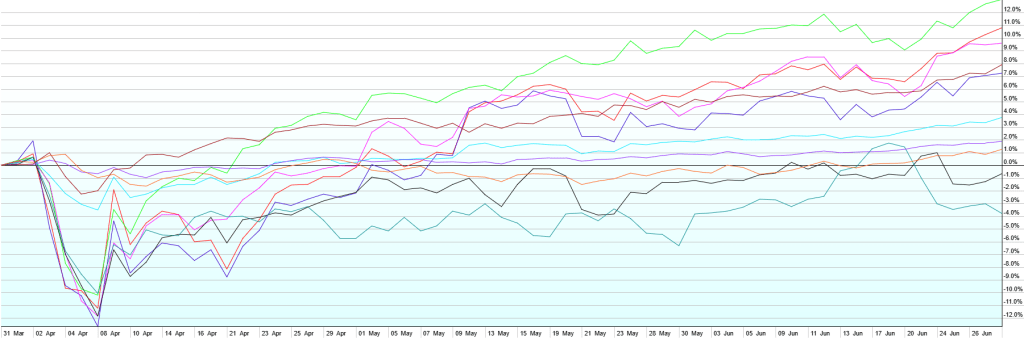

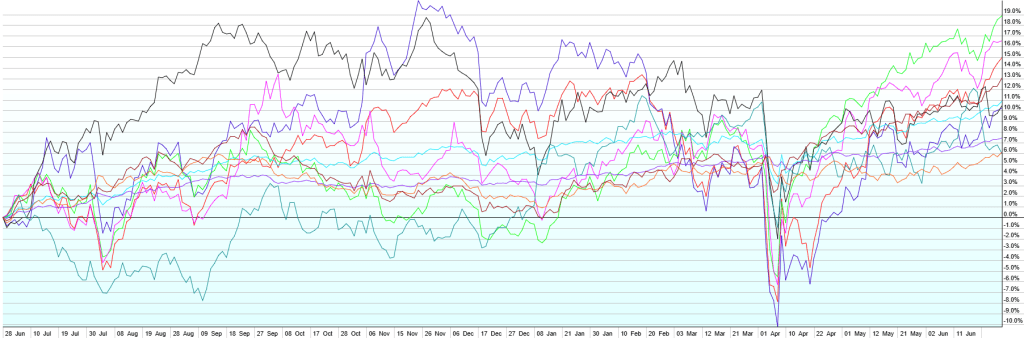

Q2 2025 experienced a lot of volatility on its way to solid overall returns. The quarter started with President Trump announcing “reciprocal tariffs” on virtually all countries on “Liberation Day”, April 2nd. Markets reacted very poorly, especially US Stocks. My thoughts from early April are here and here. Markets (US Stocks down 11-13% over that first week of April and lots of stress in the US Treasury market) seemed to force the administration’s hand toward de-escalation. A new openness toward negotiation of new trade deals sent markets into recovery mode. Foreign Stocks maintained the outperformance they showed in Q1, but all asset classes rallied, at least somewhat, for the last 12 weeks of the quarter. From best to worst: Foreign Developed Stocks (+13%) as the dollar plunged to a 3+ year low, US Large Caps (+11%), Emerging Market Stocks (+10%), Emerging Market Bonds (+8%), US Small Caps (+7%), High-Yield Bonds (+4%), Short-term Corporate Bonds (+2%), Aggregate US Bonds (+1%), Real Estate Investment Trusts (REITs) (-1%), and Commodities (-4%). REITs struggled toward the end of the quarter on concerns over office REITs in NYC after a self-proclaimed Socialist won the Democratic Primary for mayor. Commodities struggled after a cease-fire between Israel & Iran erased the premium that had settled into energy prices over the previous few weeks. These lower commodity prices, though, helped other assets to rally into the end of the quarter given possibly lower future inflation as a result. Lower inflation gives the Federal Reserve more cover to cut interest rates, which would provide a tailwind for asset prices. Markets are now pricing in about 2 1/2 quarter point cuts (63 basis points) between now and December, which would take Fed Funds down to ~3.75% and savings interest rates down to the low 3% range. Unfortunately for the housing market, this may not translate into lower long-term rates (a requirement for lower mortgage rates) if the Fed follows the forecasted path for the short-term. Q3 will be interesting as we could get our first Fed rate cut of the year and need to follow the progress of the One Big Beautiful Bill through Congress. If it passes, higher deficits are a near certainty and with that will come pressure on long-term interest rates to move higher. There will be lots of tax implications as well, some retroactively effective in 2025. I will post a summary of the key tax provisions if/when the Bill nears passage.