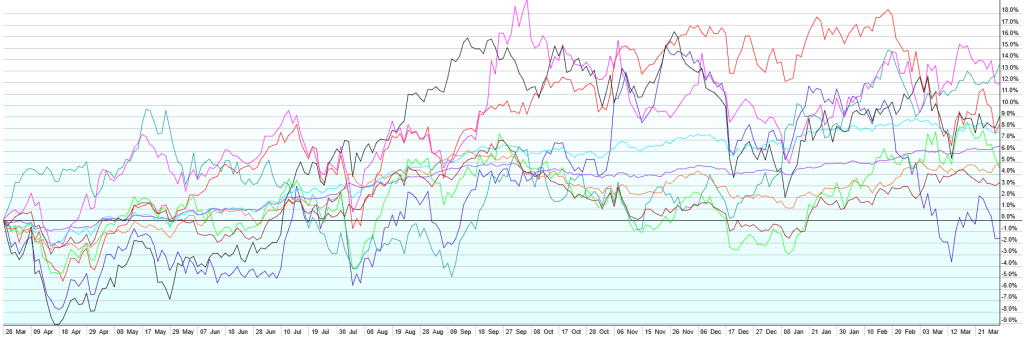

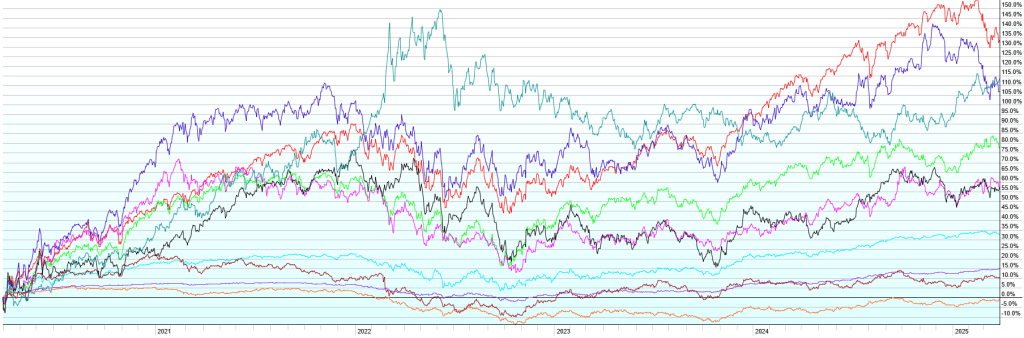

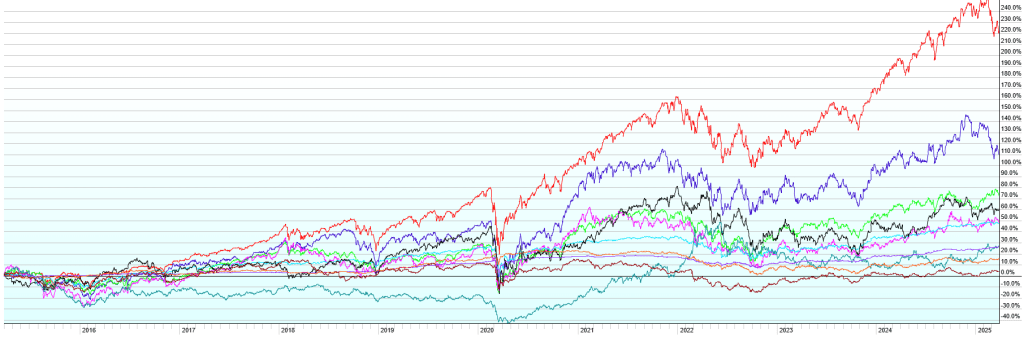

This post contains the usual returns by asset class for this past quarter (by representative ETF), last 12 months, last five years, and last ten years. While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

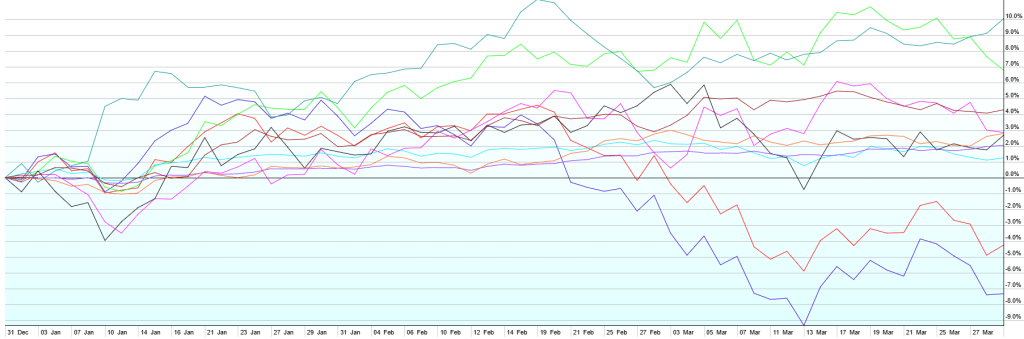

Q1 2025 was a flat-to-slightly-up quarter for most diversified portfolios despite all the news of a slowing US economy and the unknown (but almost definitely negative short-term) impact of tariffs. Diversification really paid off for the US investor. US stocks suffered over the quarter (Large Caps -4.3%, Small Caps -7.3%), but Foreign Stocks, Bonds, and Commodities performed well, offsetting those losses. Commodities (+10%) led the asset classes that we track in this quarterly message, with Foreign Developed Stocks (+6.8%) not far behind. Emerging Markets faired well too, with Emerging Market Local Currency Bonds up 4.3% and Emerging Market Stocks up 2.8%. The Federal Reserve held the Fed Funds rate steady at 4.25-4.5% during Q1, but long-term rates fell on fears of a coming recession and lower rates mean relatively strong performance for bonds. US Aggregate Bonds were up 2.8%, with Short-Term Corporate Bonds up 2% and US High Yield Bonds up 1.2%.