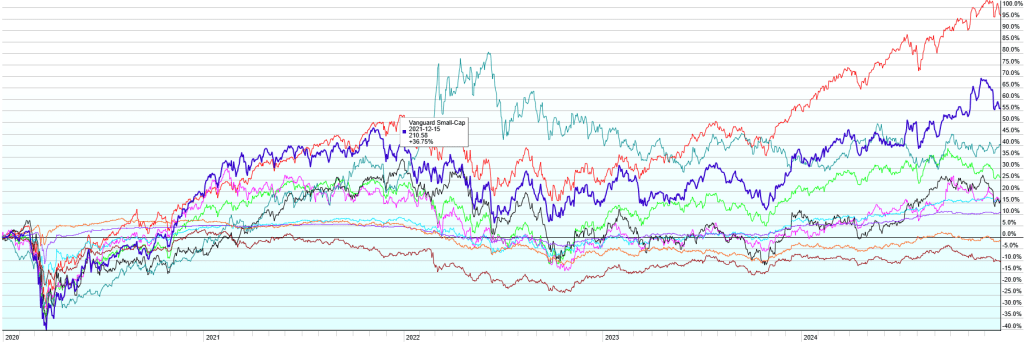

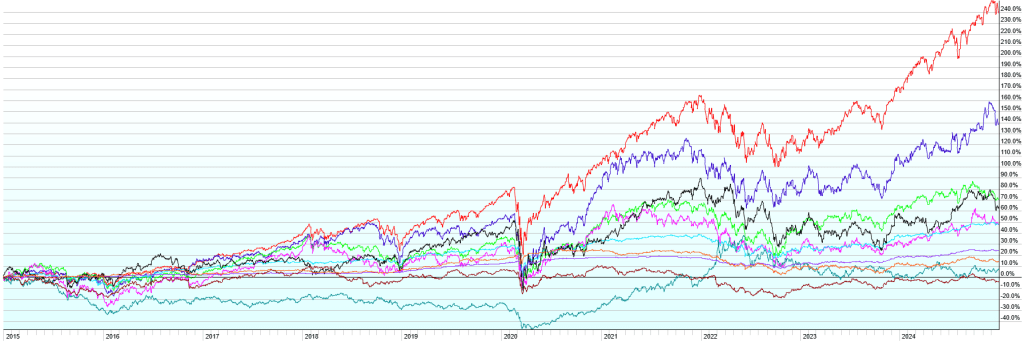

This post contains the usual returns by asset class for this past quarter (by representative ETF), total 2024, last five years, last ten years, and since the covid low (3/23/2020). While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

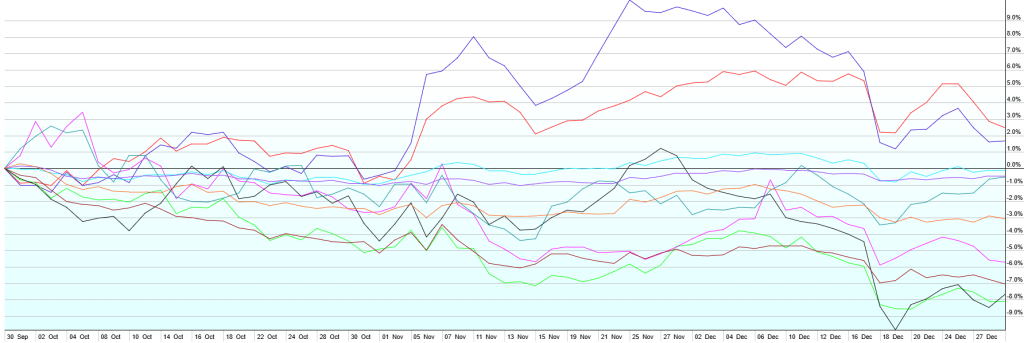

Q4 2024 was an overall down quarter for most diversified portfolios as international markets struggled post-US election, the US Dollar rallied, and long-term interest rates spiked as the inflation stagnated and the Fed continued to cut overnight rates. US stocks had a solid quarter with Large Caps up 2.5% and Small Caps up 1.7%. All other asset classes that we track for this ongoing post were down though including High-Yield Bonds (-0.1%), Short-Term Corporate Bonds (-0.4%), Commodities (-0.5%), US Aggregate Bonds (-3.1%), Emerging Market Stocks (-5.7%), Emerging Market Bonds (-7.1%), US Real Estate Investment Trusts (-7.7%), and International Developed Stocks (-8.1%).