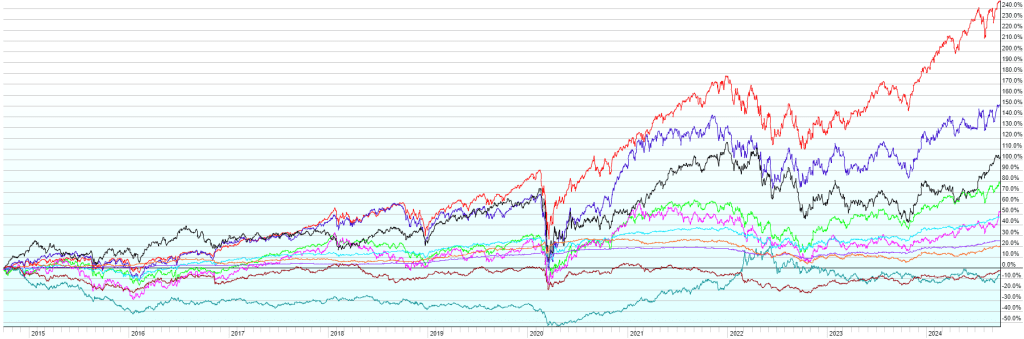

This post contains the usual returns by asset class for this past quarter (by representative ETF), year-to-date, last 12 months, last five years, last ten years, and since the covid low (3/23/2020). While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

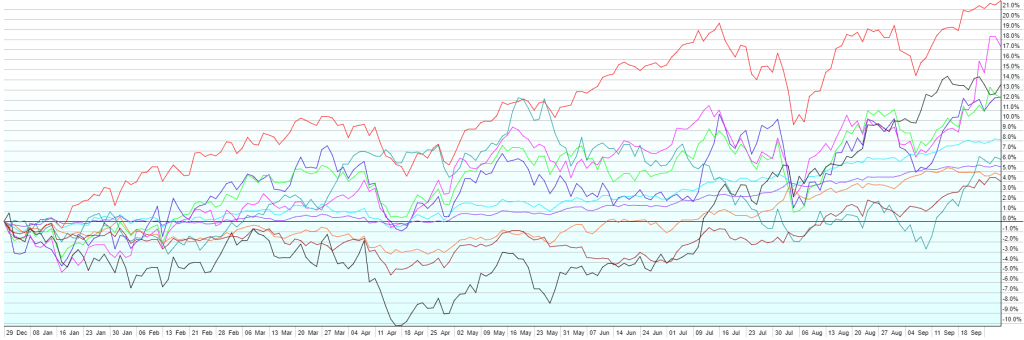

Q3 2024 was a fantastic quarter for financial markets as the US economy chugged along, inflation continued to ease around the world, China launched new stimulus measures to strengthen it’s economy, and the Federal Reserved began a rate cutting cycle with a 50 basis point reduction in the Fed Funds rate. Rather than waiting for severe economic weakness to cut rates, as they have typically done in the past, the Fed decided to cut aggressively and begin to ease up on the brakes they’ve been applying to the economy as a way of fighting inflation. All asset classes that we follow in this quarterly message posted gains, led by Real Estate Investment Trusts (+17%). In the middle of the pack, but still with strong returns, were Emerging Market Stocks (+9.7%), US Small Caps (+9.1%), Emerging Market Bonds (+8.1%), Foreign Developed Stocks (+7.1%), US Large Cap Stocks (+5.8%), US High-Yield Bonds (+5.7%), US Aggregate Bonds (+5.2%), and Short-Term Corporate Bonds (+3.8%). Bringing up the rear were Commodities, still positive at 0.6% despite a pull-back in the energy sector.