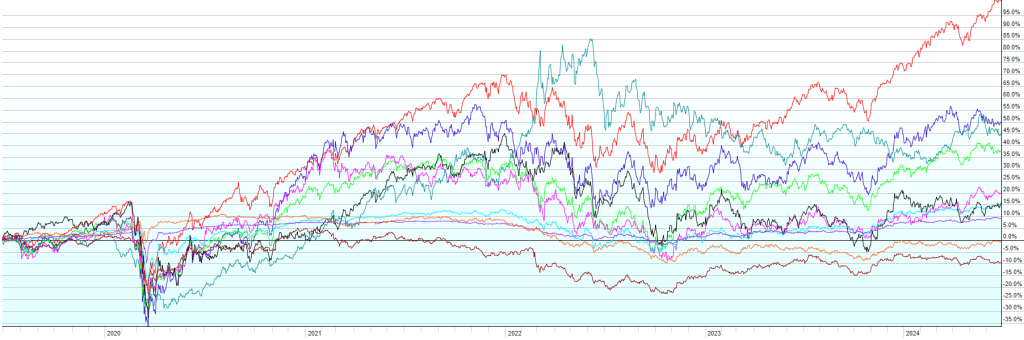

This post contains the usual returns by asset class for this past quarter (by representative ETF), year-to-date, last 12 months, last five years, last ten years, and since the covid low (3/23/2020). While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

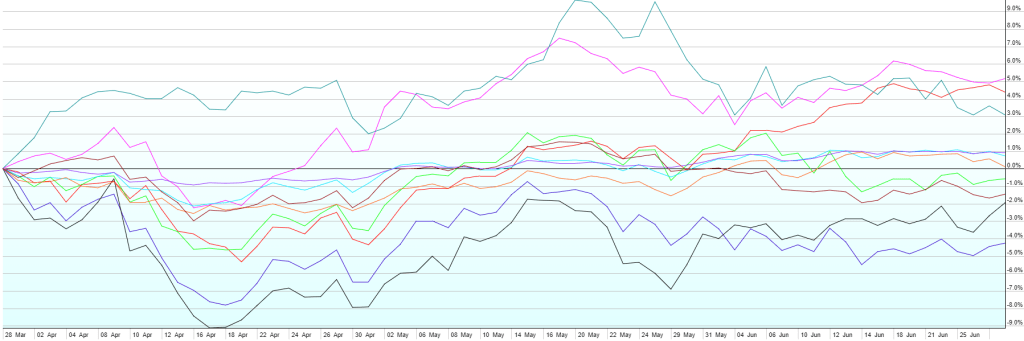

Mixed results across asset classes for Q2 kept most diversified portfolios relatively steady in Q2 2024. Emerging market stocks and US Large Cap (led especially by mega caps in tech/AI) outperformed with 5.2% and 4.4% returns respectively. On the flip side, US Small Caps were down 4.2% for the quarter with only ~38% of the stocks in the Russell 2000 closing higher than they started the quarter. In between the best and the worst were Commodities (+3.1%), US Short-term Corporate Bonds (+0.9%), US High Yield (+0.7%), US Aggregate Bonds (+0.1%), Foreign Developed Stocks (-0.6%), Emerging Market Bonds (-1.6%), and US Real Estate Investment Trusts (-1.9%).