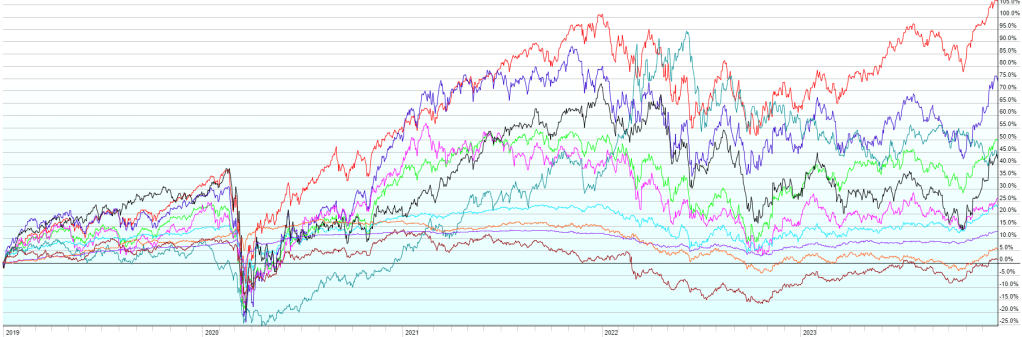

This post contains the usual returns by asset class for this past quarter (by representative ETF), full year 2023, last five years, last ten years, and since the covid low (3/23/2020). While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

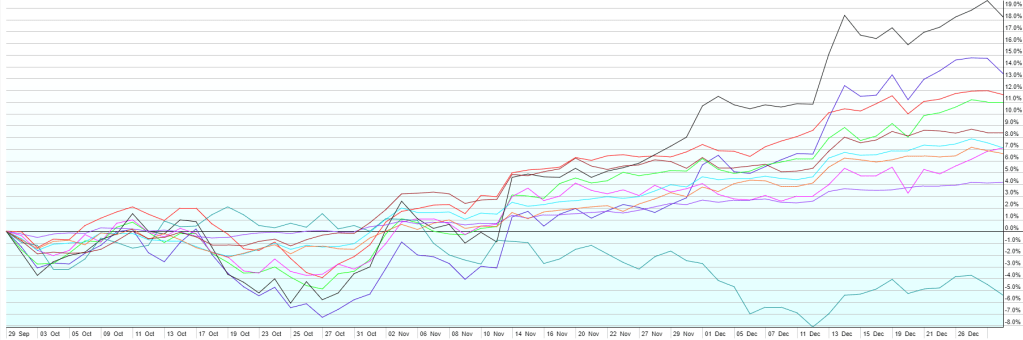

The rollercoaster continued in Q4, with fantastic returns across the board (excl. commodities, but that’s probably a good thing and it’s another indicator of disinflation), after an up Q2 and a down Q3. Long-term interest rates pulled back as the Federal Reserve appears to have started their pivot toward rate cutting sometime in 2024. They left the door open for further hikes if inflation roars back, but after consecutive soft monthly inflation reports, the Fed is now forecasting three rate cuts (to 4.5-4.75% Fed Funds) by end of 2024. The benign inflation reports and the pivoting Fed sent stocks and bonds off to the races. REITs ended the quarter up more than 18% as the top performer (though that just puts them into the middle of the pack for 2023 as a whole. US Small Caps were up 13.4% with the seemingly ever-raging Large Caps up 11.6%. Foreign Developed (+11%), Emerging Market Bonds (+8.4%), Emerging Market Stocks (+7.1%), and High-Yield Bonds (+7.1%) round out the aggressive side of portfolios. The conservative side also had great returns with US Aggregate Bonds up 6.6% and US Short-Term Corporate Bonds up 4.1%. Commodities (-5.4%), as mentioned above, were the only sore spot for the quarter, with energy prices dropping as the disinflation narrative took hold. It remains to be seen if the Fed can engineer a soft landing for the economy with inflation falling back toward their 2% goal, but without a spike in unemployment and a recession. High interest rates take their toll on economic growth and they work with the “long and variable lags”, about which, the Fed always reminds us. Stocks seem to believe the soft landing is a lock. Bonds seem to believe disinflation is a lock and the Fed is going to go into easing mode. If they’re both correct, 2024 will likely bring more gains with it. If not, it’s going to get interesting, especially for the more expensive areas of the market like US Large Cap stocks.