This post contains the usual returns by asset class for this past quarter (by representative ETF), last year, last five years, last ten years, and since the covid low (3/23/2020). While there is still no predictive power in this data, I’ll continue to post this quarterly for those of you that are interested.

A few notes:

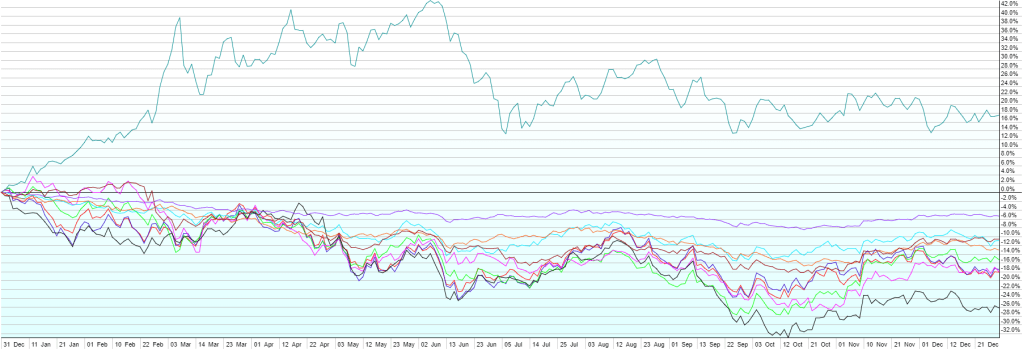

- Q4 was a strong quarter (even stronger if we could erase December) that ended a terrible year for everything other than commodities. Developed foreign markets led the way (+17%) as the US dollar finally cooled. Emerging market stocks, emerging market bonds, US small caps, and US large caps all had solid performance of +7-9%. High yield (junk) bonds returned +5% with real estate just below at +4.3%. Commodities ticked slightly higher (+2.4%) and after a miserable year, bonds crawled ahead as interest rates finally took a breather. Short-term corporate bonds were up 2.2% with the aggregate bond index up 1.6%.

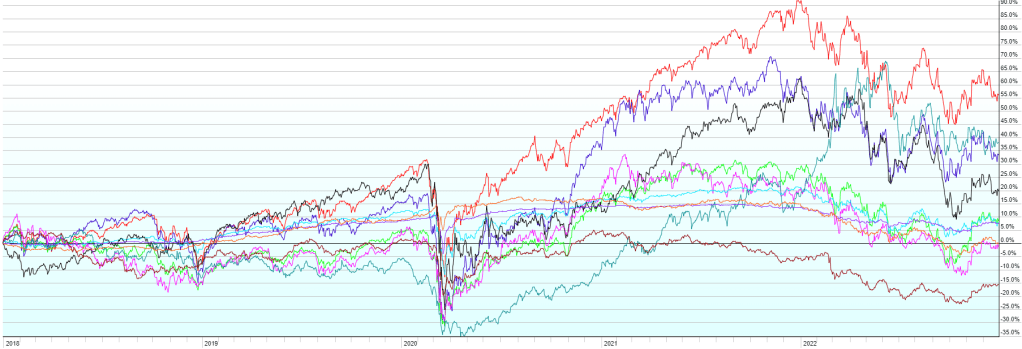

- While many will remember 2022 as an excess of destruction in financial markets, it really was a destruction of excess. The areas that fared worst were those that saw substantial gains in previous years, leading to rich valuations by virtually every measure. I’ve mentioned Large Cap Tech multiple times in previous “market update” posts as an area of concern in an otherwise fairly priced market. 2022 brought it back to reality with the Nasdaq 100 falling more than 30% and individual well-known names falling much further. The ARK Innovation ETF (ARKK) closed the year down nearly 68%. The once-loved Tesla finished down 65%. Meme stocks like Gamestop (-50%) and AMC (-76%) also came back toward reality. And crypto, perhaps the most obvious representative of speculation, was also crushed with Bitcoin down 65%, Ethereum down 68%, and many of the smaller coins/tokens down substantially more. On the contrary, US Large Cap Value (perhaps the least representative of excess) held up quite well, down only 2.1% on the year. Destruction of excess is often a requirement of the start of a new bull market. Without a crystal ball, we can’t know when that will begin (or if it already has), but it would be very difficult to have one without cutting the excesses out of the market overall.

- 2022 was the worst year for the aggregate bond index in history, closing down 13%, after being down as much as 17% earlier in Q4. Bond prices move in the opposite direction from interest rates and with the Fed raising rates at a pace never before seen (started the year near 0% and ended near 4.5%!), in hopes of bringing inflation back toward their 2% target, bond prices tumbled. The shorter the term on the bond or bond fund, the less impact the increase in rates has though, so short-term bonds outperformed longer-term bonds. This should intuitively make sense… the shorter the time to maturity, the less time you have to wait to redeem your low-interest paying bonds and reinvest in new higher interest bonds. The longer the time to maturity, the longer you’re stuck with the low interest rates, so if you want to sell those bonds, no one will pay anywhere near your principal amount (i.e. the price falls). The good news is that we’ve gone from a world of negative and zero interest rates everywhere, to one where we can now get 3.4% in a bank account, 4.75% on a 1-year treasury note, over 5% on many high-quality corporate bonds.

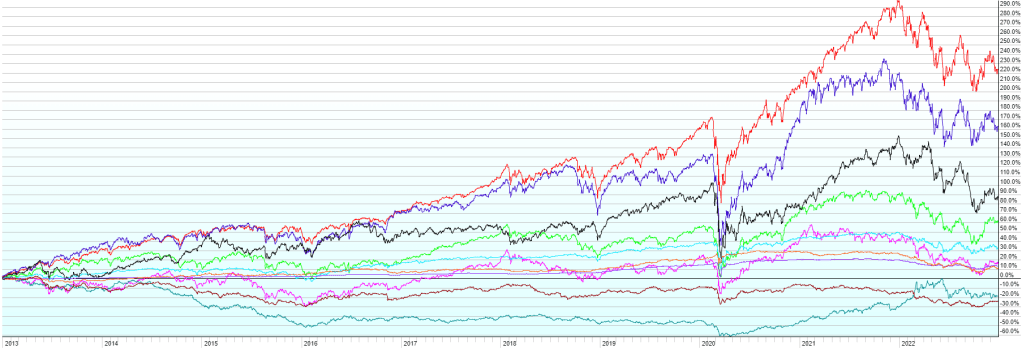

- Commodities were the one bright spot in 2022, with the Bloomberg Commodity Index returning over 17%. Commodities still have a long way to go to catch up to other financial assets over the past 10 years though as you can see from the charts above. It feels like oil, gas, etc. are all high now, but remember that 10 years ago, oil was $120 vs. today’s ~$80.