Just because you’re not writing a check, doesn’t mean you’re not paying for administration and access to your 401k. I’ve seen recent polls indicating that 50-75% of 401k participants believe they’re not paying anything for their 401k. They couldn’t be more wrong. There are two broad types of fees that plans participants and/or their employers incur: investment fees and administrative fees. All plans incur investment and administrative expenses, most plans pass those expenses onto investors in the plan as fees, and some plans do it in a way that is very difficult for the average investor to notice.

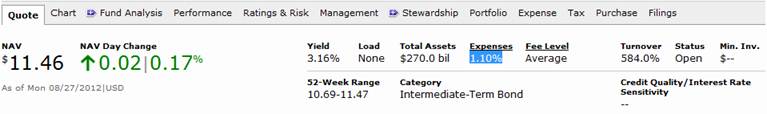

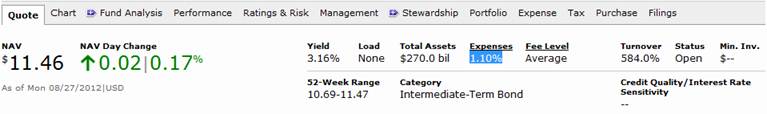

Investment fees are those charged by the investment funds themselves as a ways of generating a profit on their funds as well as offsetting the cost to create, maintain, and distribute the funds. These fees are passed onto investors in the fund (whether it’s through a retirement plan or an individual investment) through the fund’s expense ratio. You can find the fund’s expense ratio in the Fact Sheet or Prospectus for the fund. If the fund is publicly traded with a 5-letter ticker symbol, you can also look it up at Morningstar.com (snip from Morningstar for a particular mutual fund is shown below with the expense ratio highlighted).

If a fund has an expense ratio of 1%, it means that over the course of each year, 1% of the fund’s total holdings are paid to the investment company and eliminated from the fund. Another way of looking at this is that the fund’s investors each pay 1% of their fund assets each year to the investment company (e.g., if you have $100k in the fund, you pay $1k per year to the fund through the expense ratio). Because this payment takes place inside the fund, it doesn’t appear on any statements or in account histories. It simply erodes the value of the fund over time, either creating larger losses than would otherwise have been incurred or reducing gains. All funds have an expense ratio, but many funds have different classes set up with different expense ratios. The more money a retirement plan has to put in the fund, the better the class they have access to and therefore the lower the cost to participants. As will be explained below though, the lowest cost class of a fund, or the lowest cost fund for a particular type of asset (large cap U.S. stocks for example) is not always the one chosen by the plan administrator.

Administrative fees are those fees charged by a third party administrator (i.e. not you and not your employer) to do the plan recordkeeping, fulfill legal requirements, provide disclosures, file government-required forms, accept payroll deposits, payout withdrawal/loan requests, and likely provide a plan website where participants can interact with the plan. Purely administrative fees paid by plan participants as either a flat amount per quarter/year or as a percentage of account value per quarter/year are usually fully disclosed on account statements and in transaction histories. In some cases, these fees are no bourn by the plan participants, but are instead paid directly by the employer. In this case, the fees are not typically disclosed to participants since they don’t directly pay the fees. In many cases, the administrative fees are not paid by the investor directly or by the employer directly, but are instead paid by the investment companies that provide the funds in the plan in the form of a commission. In these cases, the plan administrator typically selects investment funds that have a fairly high expense ratio for participation in the plan (either higher cost classes of certain funds, or higher cost funds of certain asset classes. The investment companies earn more on these funds than they would if lower-fee funds were selected, so they provide a portion of the difference to the administrator to compensate them. In this case, the administrative fees are not shown on participant statements or in account histories. They’re harder to track, and process is more convoluted (reminds me of the healthcare system of payments – but that’s another blog post for another day), but it should still be clear that the investor is paying the administrative costs nonetheless. As an extreme example, one of the worst 401k plans I’ve seen has only investment funds in it with expense ratios well over 2%. Some of the best plans have funds with expense ratios as low as 0.02%. You could argue that this means 1.98%+ of those fund fees are in excess of what they could be and that the investment company and the plan administrator are sharing those profits. If you use that 401k plan and you slowly build assets to over $500k with an average balance of $100k in the plan over 20 years, you are paying 1.98% in excess fees per year * $100k average annual balance * 20 years = $39,600 in excess fees! In many plans, there are good funds from an expense standpoint and there are bad funds. Cherry-picking the good ones and then using other retirement accounts (a spouse’s 401k/403b, IRAs, Roth IRAs, etc.) to fill in the rest of your retirement asset allocation is a good way to minimize the fund/admin expenses that you pay, and something that any good financial advisor should help you do (or do for you as is the case with PWA clients).

Recent law changes by the Department of Labor have increased the disclosures required by 401k plans so that you, as the plan participant, and your employer as the sponsor of the plan, can get a better idea of the fees that are being charged directly and indirectly. These disclosures become mandatory this month for most employers and quarterly statements will include fee information going forward by the end of the year. As part of the process, many plans are introducing new fund selections and/or changing the way they deal with administrative fees in the plan (e.g. billing them directly per participant rather than using the commission method described above). Please communicate any plan changes and send any fee disclosure documents to your PWA advisor so that we can recommend any changes you should make to your plan investments as a result.

Having access to a very diversified set of investment options in a tax advantaged retirement plan is something that is worth paying for. However, you and/or your financial advisor should know how much you’re paying for it and make sure that you’re not getting ripped off and are taking advantage of the best low-cost investment vehicles available to you.