I’ve written a number of these notes over the last 18 years (sheesh… time flies) as an advisor. Banks Teetering (Silicon Valley Bank Goes Under) 2023, Inflation Spike of 2022, Covid 2020, Q4 2018 Meltdown, European Debt Crisis 2014, Fiscal Cliff 2012, Great Financial Crisis 2008/9. Every one of those situations felt terrible. Every one was a crisis at the time, some worse than others, but all resulting in stocks selling off and anxiety rising. Every one of them ultimately resulted in the all-time highs we had on most stock markets just a few months ago. Every one was not reason to panic. Here’s a little secret… this one isn’t a reason to panic either.

Why not panic? Most importantly, when times are not stressful and anxiety is not running high (i.e. when rational thinking prevails), we help our clients set a financial plan, an asset allocation, and a level of risk that they’re comfortable taking. We remind them that risk is what allows risky assets to generate long-term returns that exceed those of risk-free assets. We tell them that in a bad financial situation like the Great Financial Crisis, they are likely to lose 50% of the assets that they have in stocks. We all but guarantee that at some point, something financially bad is going to happen and that 50% loss will occur. It’s actually happened 3 times in the last 25 years! And yet we all agree that the average long-term returns are worth the short-term risk, or almost guarantee, of loss. Why would the occurrence of something that we agreed would almost definitely happen cause anyone to panic? It shouldn’t. Keep in mind that we’re not telling near-retirees to keep 100% of their money in the stock market and simply accept they might (will) lose 50% of it at some point. If you’re nearing retirement and you have all or near all of your money in risky assets like stocks, you’re not a PWA client and you’re doing something very wrong!

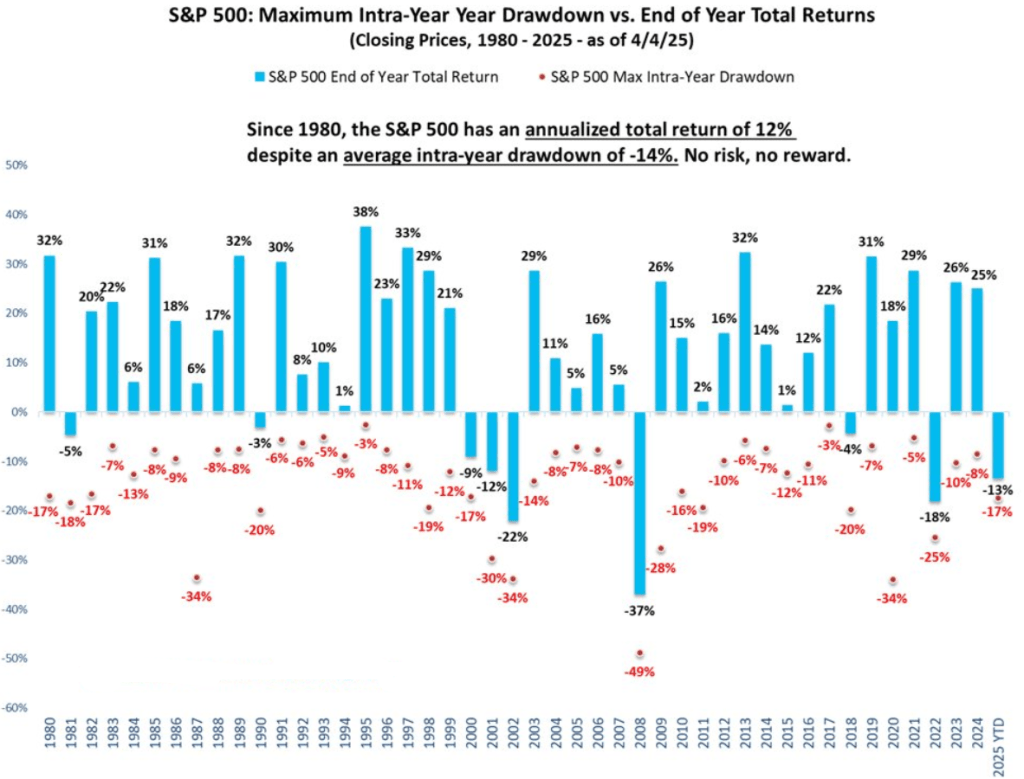

While we can’t see the future, we can look to the past for guidance. Stock market volatility is routine. Charlie Billelo, chief market strategist at Creative Planning, recently updated a JP Morgan chart showing S&P 500 returns by year (avg 12% since 1980) vs. the maximum drawdown in each year (avg 14% since 1980). As of Friday’s close, the S&P500 was down 17% from the high and 13% year-to-date (substantially more on small caps, less on international stocks and bonds have been up). Far from out of the norm. In 2020, we were down 34% from the highs and ended the year up 18% from where we started.

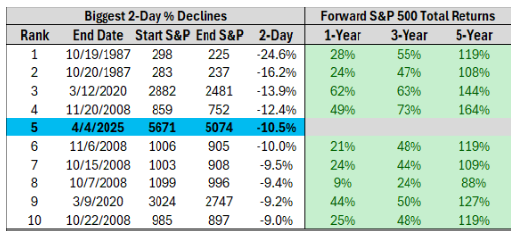

We’ve had a terrible last two days in the stock market, but if you look at previous terrible two days in the stock market, returns have been quite quite good from there in the future.

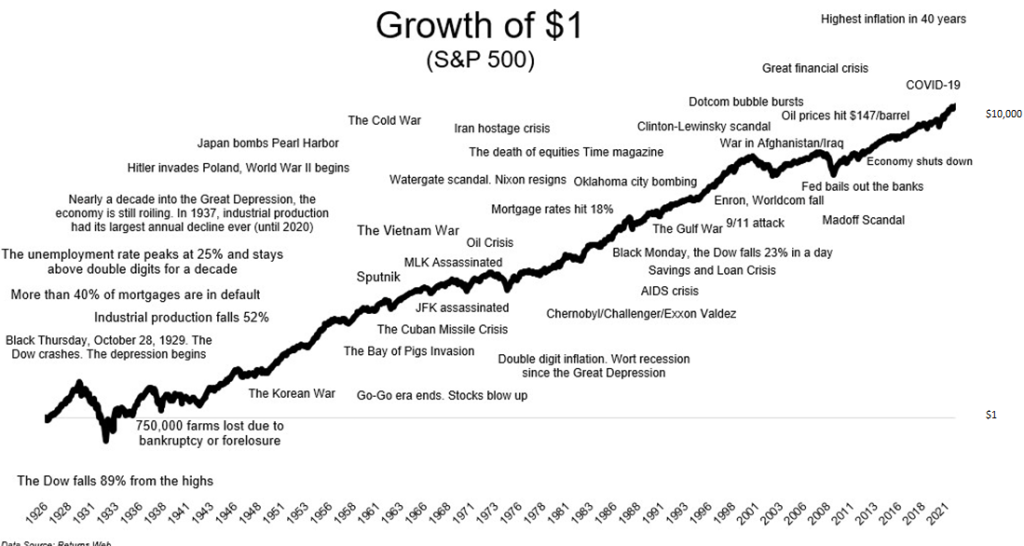

History is filled with potential economic crises (small sampling on the chart below).

The future will also be filled with them. Our debt-laden society makes them worse because even small changes in asset prices cause those that invest on leverage (borrowed money intended to amplify returns) to take large losses. Margin calls then cause forced selling which further magnifies losses. This tends to continue until the overly aggressive investors looking to get rich quick are wiped out, and those patient long-term investors with the ability to rebalance and “buy low” step in. As I type this, futures point to another day of sharp losses tomorrow. Maybe justified by economic policy (a clear policy error in my view… another post on that coming shortly), or maybe just some of that forced selling that tends to follow sharp moves lower in stocks. There’s no way to know. What we do know is that falling stocks are an opportunity to rebalance and “buy low” by selling bonds and buying stocks the same way as rising stocks are an opportunity to rebalance and “sell high” by selling stocks and buying bonds. Volatility, exploited this way, is opportunity. It’s certainly NOT another reason to panic.

Pingback: My Take On Tariffs | PWA Financial Tastings Blog

Pingback: Q2 2025 Returns By Asset Class | PWA Financial Tastings Blog