On August 8, President Trump issued executive orders related to the extension of expanded unemployment benefits, the deferral of employee payroll taxes, an extension to the waiver of student loan payments and interest, and a directive to various cabinet members to take action to prevent residential evictions and foreclosures resulting from financial hardships caused by COVID-19. These orders were an attempt to circumvent the need for congressional action on additional COVID-19 assistance, which seems to have at least temporarily, resulted in a standoff in the Senate. The provisions in these orders are complicated and may result in legal challenges. There has been some additional guidance issued by the Dept. of Labor and FEMA, both of whom are involved in implementation. Below is a quick summary of what I understand so far related to these orders.

Unemployment – the CARES Act provided $600 per week of federally funded unemployment insurance benefits, in additional to standard state funded unemployment benefits. The additional $600 per week benefit expired on July 31, 2020. This executive order and supplemental guidance authorizes states to voluntarily apply for aid from FEMA to fund an additional $300 per week benefit from August 1 through December 27, not to exceed $44 billion (which would only last about 5 weeks given the number of currently unemployed people). While the original order called for a $400 per week benefit, only 75% was to be Federally funded, with states picking up the additional 25%. Given fiscal issues at the state level, additional guidance was provided that states could treat their $100 per week as additional unemployment compensation or as a portion of their existing unemployment compensation paid (i.e. make the additional benefit $400 by taking the FEMA $300 and adding $100 to the current amount they pay OR make the benefit $300 by taking the FEMA $300 and treating $100 of the current unemployment benefit calculation as part of the program). Participation is up to the states and many seemed to be waiting for the supplemental guidance on their $100 per week portion before applying. To date, SD has announced it will not participate and AZ, CO, IA, LA, MO, NM, and UT have applied and been approved. It is unclear when payments will be able to begin for participating states due to administrative delays in changing unemployment systems to comply. Some states may begin in late August, with others starting payments in September. Some states, like SD, may choose not to participate at all. In order to receive the $300 or $400 supplement, individuals need to be collecting unemployment at a rate of at least $100 per week and must certify that they are unemployed or partially unemployed due to the disruptions caused by COVID-19.

Payroll Taxes – this order directs the Treasury Secretary to defer the collection of the employee portion of social security taxes (currently 6.2% of the first $137,700 of wages earned in 2020), for Sepember 1 – December 31 without interest or penalties. It also directs him to “explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred” (i.e. forgive the taxes, rather than just defer them). This would apply for workers earning less than $4000 per bi-weekly period (adjusted equivalently for other payroll periods). Additional guidance is required from the Treasury Secretary as to how this program will work. In practice, employers collect Social Security taxes as the FICA portion of payroll taxes. If they fail to collect these taxes, they are generally responsible for paying them on behalf of the employee. That means that if an employer allows an employee to defer the tax to post-12/31 and the employee cannot pay, the employer could be on the hook for these taxes. From an employee perspective, deferral of the tax for a few months isn’t a big help if the bill then comes due in January for the whole deferral period. However, if the deferred taxes are forgiven, that would be a huge help. Payroll taxes can’t really be forgiven without Congressional action though, so forgiveness seems uncertain. Without additional guidance, it would be difficult for an employer to stop collecting the social security taxes. Even if they did participate and offer it to employees, it may cause financial stress in early 2021 for those employees that participate and need to pay the deferred taxes. Of course if there is any chance of forgiveness that is dependent on deferring the taxes to 2021, then employees have a strong incentive to participate as much as their employers allow them to. We’ll have to wait for further guidance to understand how (if) this order will ultimately work.

Student Loans – the CARES Act provided for deferral of student loan interest and payments through September 30, 2020. This order effectively extends that (voluntary) deferral period through December 31, 2020.

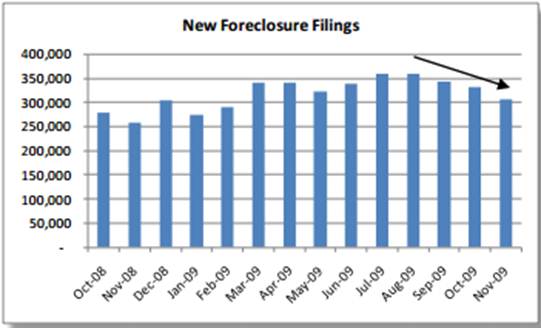

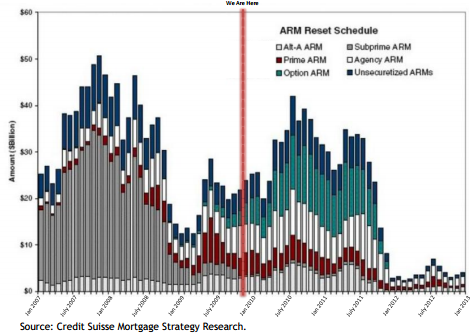

Housing Assistance – the CARES Act issued a moratorium on evictions that expired on July 24, 2020. This order does not extend that moratorium. Instead, it directs various cabinet member to take action to find ways to minimize residential evictions and foreclosures during the ongoing COVID-19 national emergency, to review existing authorities that can be used to prevent evictions, to identify funds that could be used to help renters and homeowners, and to consider whether any further halting of evictions are reasonably necessary to prevent further spread of the virus.

Congress has adjourned through Labor Day, so barring any emergency callbacks, which look to be a very low probability at this point, guidance on the programs above is all we’re likely to get from now till then. I suspect there will be another stimulus act passed in September/October, but these executive orders are likely to be it until then.